Commercial Sales in Brooklyn

BROOKLYN HEIGHTS $19.6 MILLION 20 Henry Street GMAP Urban Realty Partners bought a 7-story, 45,990-square-foot vacant loft building in the Brooklyn Heights Historic District from Broadway Management & The Praedium Group. The LPC has approved plans to add a a 4-story, 14,500-square-foot residential apartment building on the vacant land adjacent to the existing building. Urban…

BROOKLYN HEIGHTS $19.6 MILLION

20 Henry Street GMAP

Urban Realty Partners bought a 7-story, 45,990-square-foot vacant loft building in the Brooklyn Heights Historic District from Broadway Management & The Praedium Group. The LPC has approved plans to add a a 4-story, 14,500-square-foot residential apartment building on the vacant land adjacent to the existing building. Urban Realty developed the the Arches condo in Cobble Hill. Massey Knakal Realty Services handled the sale, which closed on September 18th.

DITMAS PARK/FLATBUSH $12.6 MILLION

2211 Ditmas Avenue GMAP; 2225 Ditmas Avenue GMAP; and 585 E. 21st Street GMAP

Carnegie Management bought three apartment buildings in Ditmas Park/Flatbush from Baruch Singer, according to public records. The buildings have a total of 133 units, and the deal closed on August 28th. Brooklyn-based Carnegie is best known for converting converting the Estey Piano Company factory in Mott Haven into live-work lofts; back in Brooklyn, the firm’s gotten press lately for a large condo it’s developing in Bushwick.

I believe the economy is built on thirty dollar a barrel oil, and the government is

going to have to periodically mail us maybe

quarterly adjustments, that is extra money

to fill up our gas tanks so we can get to

our jobs. It takes along time to make adaptations to increased energy prices, and

people will need an adjustment check to do

this, or we will lapse into a depression. Our

dollar will strengthen as we make this adaptation, as we will spend less on all the

imports. It will take time. Before the Bush

administration announced the rebate plan on

our taxes, he first went to Saudi Arabia to

beg for more oil pumping, then I saw him

shrug his shoulders when he told a journalist,”maybe they haven’t got it”, and

no one really knows how much oil is left in

the ground anywhere. People will adapt over

time to the new energy equation and spending

will shift. Our old way of life is essentially dead. As oil takes more and more

of our money, as food costs us more and more

as oil drives food costs, too, our priorities

will shift. People will wear clothing for

many yrs. Restaurants will fold. Malls will

empty. Some will get rid of cell phones and

cable. No matter what the Fed does, it cannot

give us cheap oil if it is no longer in the

ground. Why give the money to the rich, why

not just send it out now to the masses so they can at least get to their jobs, that is

the ones who still have one. Our housing

bubble just encouraged people to move far

from work to homes they could afford, but

they still need to work, and sending them

gas stipends for a time will give them time

to make adaptations so they can shift the

stipend away from the gas tank. Everyone

can make fun of the tax rebate plan, but

maybe this will stem food riots from happening here. It is cheaper than prisons

and police.

4:57 whine? I think 2:12 is getting at something that confronts a lot of investors/developers, and that is the favortism some brokers give certain bidders. Must be some type of a kickback scheme going on here. I am sure a seller is always interested in the highest price, all else being equal. Sounds like 2:12’s offer didn’t even make it to the seller. He should be happy though as the guy at $19.6MM has his work cut out for him. From what I have heard the entire existing bldg’s interior needs to be rebuilt.

And it’s landmarked (unlike those concrete monstrosities across Henry Street.) Now THOSE are eyesores!

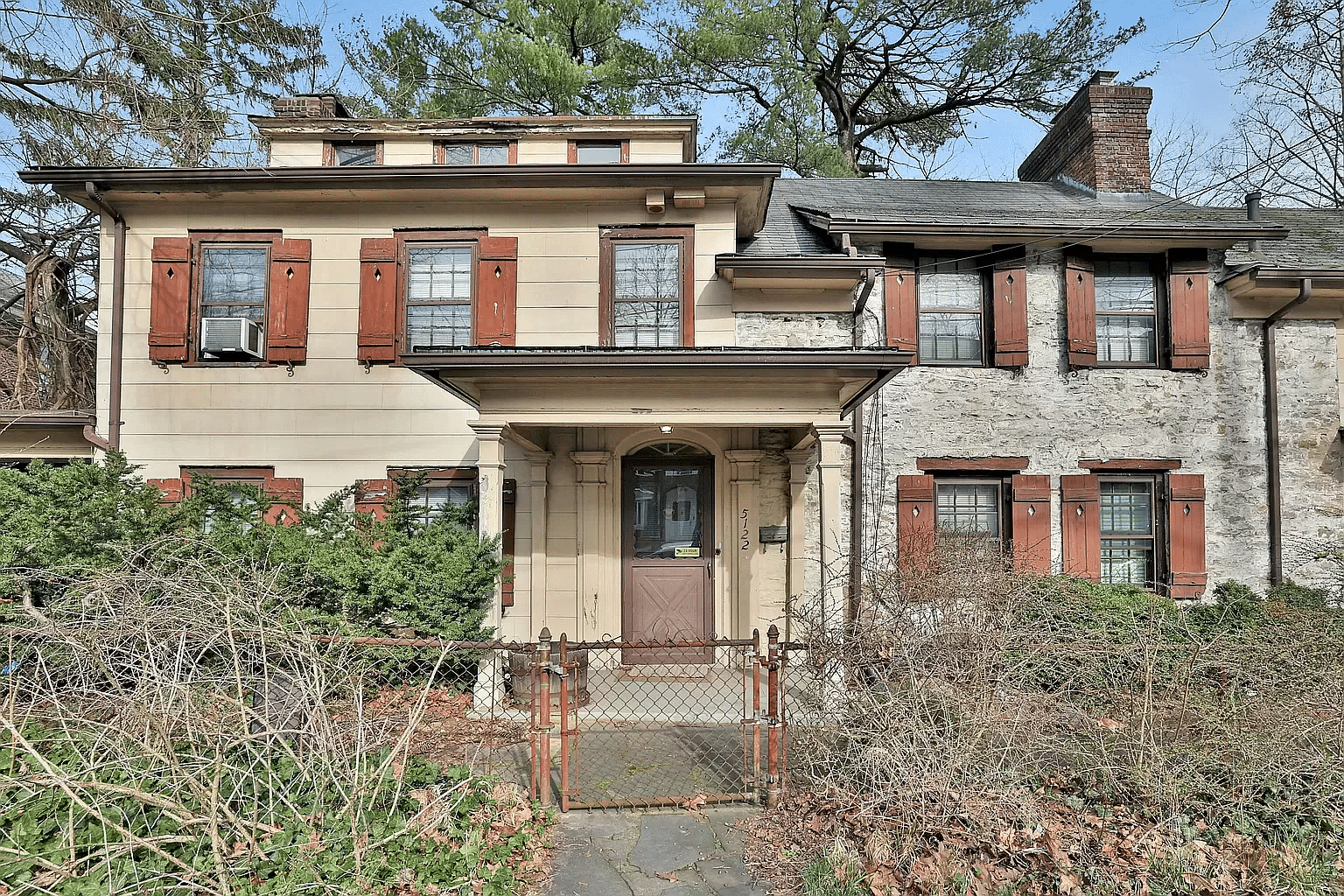

It’s actually a beautiful old building that needs to be fixed up.

Sam:

The building and courtyard are eysores only because they kicked out the tenants and haven’t maintained it for 4 years (see 3:24 above).

There are only two inconvenient obstacles to getting a garage in the neighborhood: government intervention and supply and demand. There’s no way LPC and BHA would allow a new above-ground, parking garage-only use in the Heights. Second, even if they did, Love Lane demonstrated supply/demand quite nicely. It didn’t close after many years just to spite its customers (though it often felt like it). Clearly that property was more valuable as a condo development than as a parking garage. If car owners were willing to pay an amount greater than what the owner could get from selling condos, then they’d keep it as a garage. But they’re not. Same story goes for the use of this empty lot.

2:12 do you want some cheese with that whine? 4:36, an eyesore? But you would rather have a parking garage? Are you crazy?

This building is an old eyesore and the park next to it is even worse. I suppose it could be restored to look better, but what the Heights really needs right now is a parking garage. If someone builds a four or five story garage in the vacant lot next to this, they will make a fortune.

20 Henry was once a Mitchell-Lama building specifically designated for artists. All the tenants were evicted about 4 years ago when the landlord left the program. The “vacant” land adjacent to the building is a courtyard and garden that was tended to by the former tenants.

2:52 here again. I also forgot to ask you, what is your story, The What? I know you said you are a broker, but do you live in Brooklyn? What neighborhood? Do you own or rent? If you do own, (i) is it an entire building or just an apartment and (ii) when did you buy? Given the pending doom, are you going to sell your place given you think prices are going to drop even farther, rent and then buy again when they fall later? Do you have a degree in economics? Other than sitting for a broker license (which anyone can do), what are your real estate credentials? Anyone can find articles to paste onto websites that support anything they feel like preaching. Since you have clearly proclaimed yourself THE expert on all matters concerning the economy and the real estate market, shouldn’t you provide us with proof of said expertise if you want to be taken seriously?