Last Week's Biggest Sales

Pretty brisk business in the brownstone neighborhoods and a head-scratcher in Manhattan Beach. 1. COBBLE HILL $3,950,000 13 Tompkins Place GMAP (left) This 4,100-sf townhouse was originally listed for $4.5 million in February, according to StreetEasy. Asking dropped by a quarter mil about 5 months ago. House has two units, one of which is a…

Pretty brisk business in the brownstone neighborhoods and a head-scratcher in Manhattan Beach.

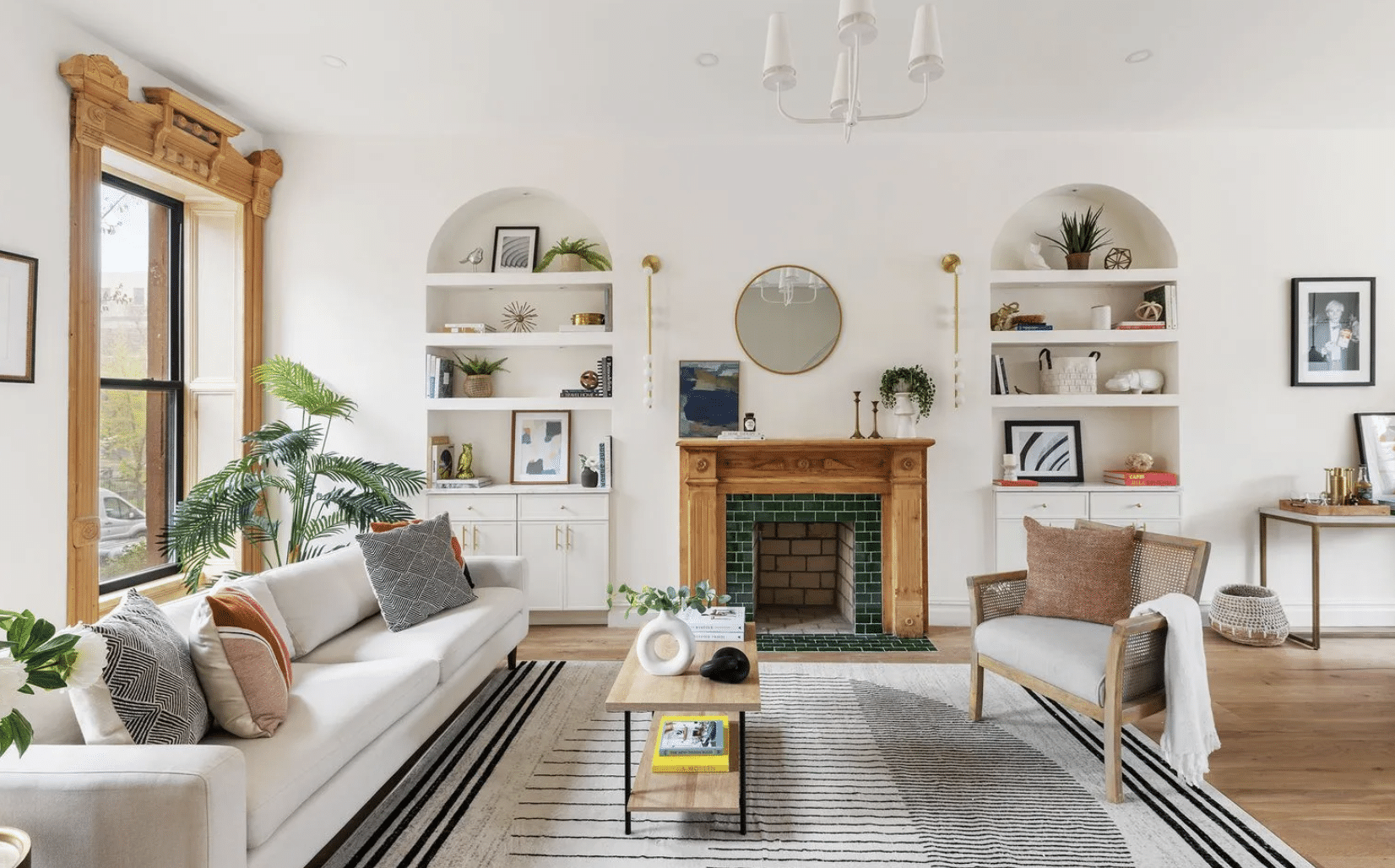

1. COBBLE HILL $3,950,000

13 Tompkins Place GMAP (left)

This 4,100-sf townhouse was originally listed for $4.5 million in February, according to StreetEasy. Asking dropped by a quarter mil about 5 months ago. House has two units, one of which is a 5-bedroom triplex. Deed recorded 9/02.

2. MANHATTAN BEACH $3,050,000

150 Hastings Street GMAP (right)

3,532-sf house on a 6,000-sf lot half a block from Manhattan Beach Park. Property Shark records show it last traded for $800,000 in 2005—quite the meteoric appreciation.

3. BOERUM HILL $2,700,000

253 Dean Street Street GMAP

20 ft x 42 ft townhouse with an owner’s triplex and rental unit. The property sold quickly: It was listed for $2.495 million in late May. The Los Angeles-based person who signed as a trustee for the purchase has the same name as someone who’s reportedly dating a star of the TV show “Grey’s Anatomy.” Coincidence? Deed recorded 9/03.

4. CLINTON HILL $1,895,000

298 Lafayette Avenue GMAP

3,496-ft, 2-family house priced at $1.995 million when it was an Open House Pick this May. Deed recorded 9/03.

5. CARROLL GARDENS $1,830,000

16 4th Place, Unit 1 GMAP

Triplex condo in a 19th century townhouse. Listed in April for a hair above the closing price, according to StreetEasy. Deed recorded 9/02.

Photos from Property Shark.

And it would seem that prices collapsing would actually make it even more likely that people would hunker down and not sell given the fact that they won’t get the price they need to break even. So we are here to stay dumbass>

Twat, to give your post more thought than it deserves, I would reiterate my question from earlier in this thread. If all of this doom and gloom comes to pass and we are in fact in Depression 2, why would that make us leave the homes we have bought? Yes it would be a drag, and yes the value of people’s homes will have collapsed but folks still have to live somewhere. So despite your cackling you will still have us as neighbors. So what is the point of your ranting? To make everyone feel worse about the situation, plain and simple. Nice gig you have carved out for yourself.

You are, by far, the biggest idiot alive twhat.

Of course you have nothing constructive to add to the conversation.

And now you think the price of oil declining is the end of everything. When the price was rising you said people were driving less and it was destroying the economy. You don’t even remember what you said.

What medication are you on? I think the general public and the FDA need to know so we can all be warned and begin the process of a worldwide recall.

You guys are smoking some powerful shit! If we have a systemic failure in our Bankings system, you mean to tell me that wont effect you?! You mean to tell me that the prices of this Mutant Real Estate Bubble will hold up?!

How you seen the Commodities lately? Oil off 35% from June, Gold off 25% sine March and Natural Gas got killed this year! When the “Hot Money” leaves the set, asset prices all fall down.

The sad thing is that you believe that prices in the Mutant Asset Bubble are the norm. The Government has to back stop this mess to prevent a world wide collapse. Fannie Mae and Freddie Mac was just the beginning.

Welcome to The Great Depression 2. It’s right in your faces but greed and delusion have you blind…..

The What

Someday this stupidity is gonna end…

@wasder 3:47, in theory yes. It’s a question of the impact of nominal v inflationary pressures. Nominal is what you see in terms of the selling prices going down, inflationary is “stealthy” and creeps up on you.

I still think there is some way to go for nominal prices to go down. After that, I see prices stagnate while inflationary pressures kick in.

@11233. I spend most of my day thinking about this stuff – it’s my job! Not to say that I’m right but I have the time to really think about it and get to the bottom of it,

Dave–you better work on that stoop!

11233–my new house is in the southeastern corner of Clinton Hill. Lewis Ave is probably no more than 1.2 miles from me.

The Chicken: I see where you are coming from now and I believe I understand your concept of price decline. This would assume that people have no equity to start with, i.e. they are not selling one property at a profit and using the net proceeds to move up the property ladder? If my understanding of your position is correct, then all of NYC is overpriced and needs some serious corrections.

I do think that there are a lot of people who liquidated one position to take a greater one. That might explain how we still have some huge prices on places in Park Slope. Now that the market has tightened, people will simply sit where they are until they get a sense of the market. I think it will take a life event (kids) for people to move from, say, a co-op to a house. And that house will probably not be in Park Slope.

It is interesting since I went from renting to owning an entire house, which I think is rather rare nowadays. As such, I had to use the same factors you are using for affordability. That is what made Bed-Stuy an option for me.

The more I think about our posts, the less I think your point of view is “off-the-wall”. (Nothing personal about my initial impression.)

I am ready for that drink whenever you are.

Wasder: I live just outside the eastern edge of the Stuyvesant Heights historic district. I am around the corner from Dave. So when I tell you that his stoop needs some attention, I know of what I speak!

As much as it looks like we made opposite decisions in the location v pricing decision, I consider my decision a compromise between the two. Depending on where 11233 lives it could be within a mile from where I bought. Plus I bought the cheapest house in Clinton Hill that I saw anyway (or at least the cheapest one I could imagine living in), so price was definitely a big part of my consideration.

In re your analysis about prices, are you saying that if house prices remain flat over the next decade while real wages go up that you are considering this a price cut? I get how it is in real terms a price cut but just trying to make sure I understand where you are coming from. Because I suspect something like that might happen for the next few years in Brooklyn real estate.

Thanks for your comments 11233 and wasder.

I must admit personal bias since I don’t own there yet but by acknowledging this I hope I’m able to limit bias in my analysis.

The days of flipping are behind us but how far behind us are they? I don’t know where to get this data but it might be interesting to compare the number of transactions from the run up (less what could be considered the “normal” run-rate for house sales. ie those genuinely purchasing a family home) against the numbers sold since the peak. That might give an indication of the level of investor/flip property backlog.

11233 – the ratio I’m using is an affordability one. There are lots of factors that go into it but the main ones are; income, taxes, target savings ratio (both for deposit and for disposable income), interest rates, and repayment schedules. My estimate for the fall is based upon the real level, not the nominal. For example, if (through inflation) everybody made twice as much money as they do currently but house prices remained the same then that is a 50% fall in my books.

I’m not using this as a way to backtrack on my expectation – it is a real issue. My dad’s first house cost him gbp2,000 and is now worth about gbp70,000 so that looks like some real appreciation (it was over a long time!). However, when he first bought the house he was making gbp15 a week (approximately a 2.5x multiple of annual gross income) and someone doing the equivalent job now makes about gbp15,000 pa so the same house is on a 4.7x multiple. The “appreciation” in value over time that I prefer to look at is not 70,000/2,000 (3,400%) but 4.7/2.5 (88% increase) – big difference!

The prices above are, in my opinion, transaction marks on the way down. If I am right then subsequent transactions for similar houses will keep coming down. If I’m not then they’ll start going up (adjusted for the inflation factor described above).

The two of you have taken opposing sides to location v pricing decision. My first house was in an “up and coming” area of London – I got a lot more property for my money that way. My next house will be in a “nice” area of Brooklyn – because I don’t want to move again. There’s no right or wrong answer and it all comes down to personal circumstances.

11233 – it will have a wraparound porch and I will be taking you up on that drink. Might be 1-2 years though! 😉