CB1 Committee Not Digging Plans for Huge Burg Project

Last week Community Board 1’s land-use committee voted 8-1 against approving a zoning change on the South Williamsburg waterfront for a humongous development that’s on the drawing board, according to The Brooklyn Paper. The project slated for Kent and Division, which is known as Rose Plaza on the River, is supposed to consist of three…

Last week Community Board 1’s land-use committee voted 8-1 against approving a zoning change on the South Williamsburg waterfront for a humongous development that’s on the drawing board, according to The Brooklyn Paper. The project slated for Kent and Division, which is known as Rose Plaza on the River, is supposed to consist of three residential towers with 801 units between them. Board members spoke out against the development mainly on the grounds that only 20 percent of its units will be designated affordable housing, and because its proposed unit mix is mostly studios and 1-bedrooms. Is this what you think our community needs? asked Rabbi David Niederman, a committee member and president of the United Jewish Organization. It’s another development that gentrifies a community that is suffering already from a lack of housing. For their part, the development team argued that Rose Plaza would add construction jobs, affordable housing and open space to the neighborhood, and despite Williamsburg’s inventory glut they’re banking on it being a cinch to sell because they anticipate a market rebound.

This ‘Rose’ Has Thorns! [Brooklyn Paper] GMAP

Big in the Burg: Rose Plaza on the River [Brownstoner]

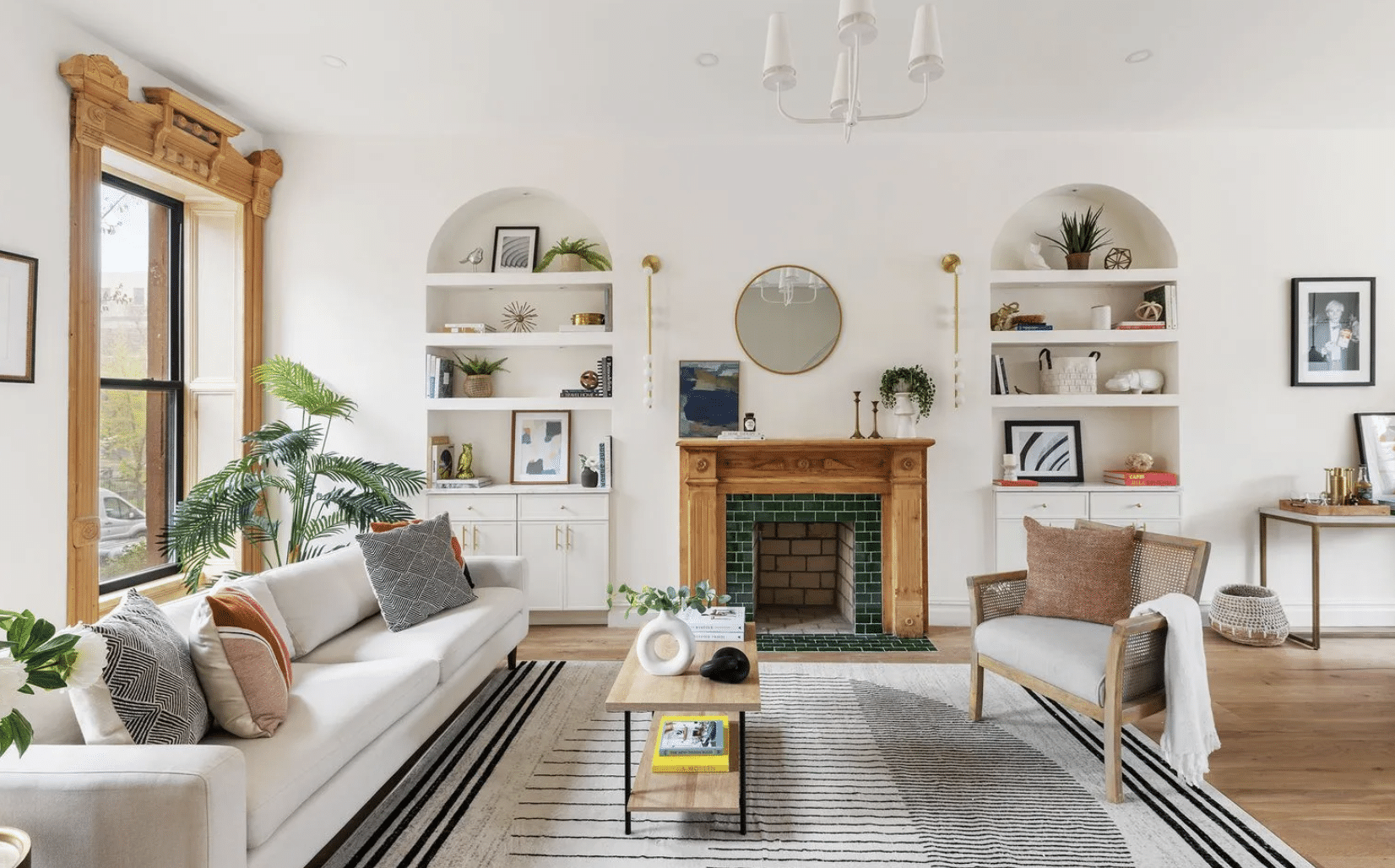

Rendering from The Brooklyn Paper

I love when they say “20 percent will be affordable” which basically means that they know the rest of the apartments are not affordable.

What I do not understand is why make all these studio apartments, who the hell wants to live in 1 room, but I guess the builders are greedy and why make it 1 bigger apartment when they can split an apartment in half and make two…

“their state assemblymen is Vito Lopez. Lopez is head of the housing committee in the NYS Assembly and the chair of the Kings County Democratic Committee”

“That’s just how it has been in NYC. You want a change in particular instance. Find a candidate and support that candidate against Vito Lopez.”

Vito Lopez supports housing discrimination? Well I have a new arch-nemesis.

So this affordable housing bullshit is just a ruse to get votes from powerful minority groups that vote in blocks? Do any of these units actually go to people who need it?

MM and Benson:

You’ve gotten to the heart of the matter. The jobs carrot is a ruse. The development costs(ie. land acquisition costs) are key.

Rob and WBer: If it is true that the Hasidim receive a lions share of the affordable units in Schaeffer Landing one reason is that their state assemblymen is Vito Lopez. Lopez is head of the housing committee in the NYS Assembly and the chair of the Kings County Democratic Committee.

That’s just how it has been in NYC. You want a change in particular instance. Find a candidate and support that candidate against Vito Lopez.

and i thought you’d be upset that i called trump dumb…

[handshake]

“developers dont borrow on the basis of their balance sheet anymore.”

Antidope;

Well, if that is the case, then I’ll have to agree with you. I was assuming that they were borrowing on the basis of their balance sheets,like the big AAA corporations are doing these days.

[handshake]

b- developers dont borrow on the basis of their balance sheet anymore. even the dumb one’s like trump have learned that’s how you bk yourself. unless there’s a developer who sees this lot at a distressed sale price (and it’s not) there is no reason they’d put a corporate loan on the books to finance it. just not happening. developments are financed on a stand-alone project basis. so it’s the balance sheet of the proposed development itself that matters. in this case the bank will look at the local market, the $$$ amount of equity put in versus the expected cost and make a determination. of course the bank would more likely lend if the developer had deep pockets and was willing to sign a guaranty.

but agreed with your last sentence. this is just not the case of a distressed ppty, unless something’s different from what we’ve surmised here. ie no mortgage. no imminent default.

“b, i think you’ve mistaken low interest rates with credit availability.”

Antidope;

Not at all. I said that IF ( and only IF)the developer has an excellent balance sheet, then credit is out there for them.

“ask yourself this, would you put 20-40% of the cost to build into this project as first loss equity today”

You’re asking the wrong guy. I don’t track the RE development market carefully enough to handicap it. As such, I wouldn’t put my money into it. I’m not saying that it’s bad deal, all I’m saying is that I only invest into something I know something about.

As I said, only time will tell if they are a genius or a fool. All I can tell you is that the biggest money in real estate has been made when someone steps into the game at the moment when things look their bleakest.

Your timing may be optimistic, antidope. The Kedem site to the north of Schaefer was approved for a similar rezoning three and a half years ago, and there hasn’t been a shoveled moved there. And that was when credit was readily available. Beyond Williamsburg in general, remember that this is market-rate housing in South Williamsburg at a time when there is a lot of inventory in prime Williamsburg.

b, i think you’ve mistaken low interest rates with credit availability. i have to agree with wber that this applicant is not likely to be the ultimate developer. that said i stick with my statement: this construction loan request would get laughed out of any credit committee unless they can prove breakeven point somewhere in bho territory (which they can’t). no shovel will move here til cycle turns and local inventory is materially reduced. wburg down cycle will inevitably be longer than elsewhere in bk bc of the massive supply. yes that could easily be more than 3-5 years, imo. ask yourself this, would you put 20-40% of the cost to build into this project as first loss equity today?