What Does the New 421-a Deal Mean for Brooklyn Real Estate Development?

A deal has been made to revive the 421-a tax break for developers. If the state approves, it will mean more new rentals and affordable units in Brooklyn.

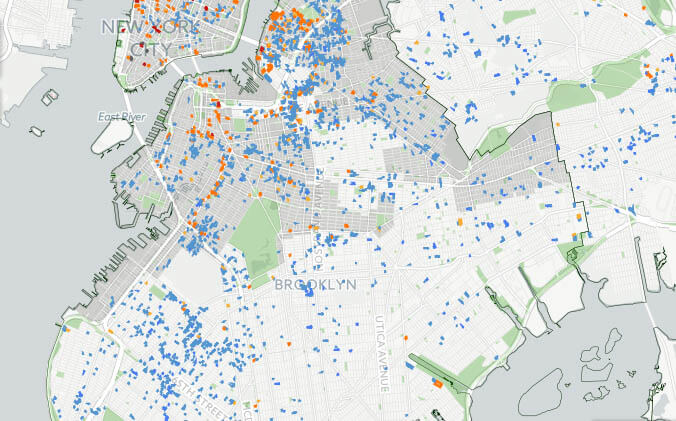

Photo by Susan De Vries

Finally, a deal has been struck over the controversial but expired tax break for developers known as 421-a. If the state legislature approves it over the coming months, it will mean Brooklynites will see more new rental buildings going up in Brooklyn — and possibly more affordable units.

First, a little background

The 421-a tax break was implemented in the 1970s to jump start construction in New York City at a time when residents were fleeing to the suburbs. It has been modified, expired, and renewed several times since then. Now it gives a tax break to developers of condos and rentals in outer-borough areas where development isn’t as profitable. In more central areas, including parts of Brooklyn and Manhattan, developers get a tax break if they include affordable housing.

Construction slowed

The tax break expired in January, and in the months since, applications for new construction permits have dropped dramatically. In Brooklyn, 18,708 units were approved in the first nine months of 2015, before the tax break expired. During the same period this year, after 421a expired, 3,112 units were approved, a slump of 83.4 percent, according to an analysis of building records by The Real Deal. Developers such as David Kramer of Hudson Companies have said without 421-a, it’s not profitable to build rentals in Brooklyn. Banks’ reluctance to lend for condos and increasing prices for land have not helped.

Here’s what’s new

- Developers of eligible buildings pay zero property tax for 35 years (up from 21 years).

- Affordable apartments with income limitations must stay affordable for 40 years (up from 35 years).

- The amount of affordable housing set aside (20 percent) hasn’t changed, despite earlier attempts to raise it to 25 or 30 percent.

- Projects with 300 rental units or more in Community Boards 1 and 2 in Brooklyn will pay construction workers on average an hourly wage of $45 (including benefits).

- Buildings with 50 percent or more affordable units don’t have to pay construction workers $45 an hour.

Here’s why the 421-a tax break is controversial

Various nonprofit groups such as the Municipal Art Society, Association for Neighborhood and Housing Development, and even Governor Cuomo have argued the break hasn’t created enough affordable housing, and the required percentages should be higher. Some buildings have flouted the rules, taking the exemption without keeping units affordable. Some argue it’s an unnecessary giveaway of tax dollars to developers — about $1.2 billion in foregone revenue. In recent weeks, Mayor de Blasio added another wrinkle: He mandated buildings that take the break set aside some units for homeless.

Here’s what developers and brokers told Brownstoner about the new deal:

Ofer Cohen, founder and president, commercial real estate firm TerraCRG:

The renewal of a 421-a program will be instrumental in re-activating the development market in Brooklyn. Since the expiration of the old program, development site trade volume came to almost a complete halt. Without a program, no new rental product can be built. If this deal goes through, we believe developers will respond with renewed activity, in purchasing, planning and breaking ground to rental unit production, a portion of which will be affordable. The 300-unit cap is great for Brooklyn because the average project size in Brooklyn is under 50 units and very few projects are over 300. This means most of the projects will not have the burden of prevailing wage requirement under the new proposal.

David Kramer, principal, Hudson Companies:

I think it’s great for the City to finalize a new 421-a deal. It ensures more housing can get built and more affordable housing will be produced.

Chris Havens, commercial real estate broker, Citi Habitats:

Let’s see how it comes out of the state legislature. Any new commercial space [in mixed-use buildings] would be welcomed.

Related Stories

- Here’s What You Should Know About 421-a and Its Incredible Impact on Development in NYC (Updated)

- Why Nobody’s Buying Land in Brooklyn Any More (Video)

- Hundreds of Brooklyn Renters to Get Payback From Overcharging Landlords

Email tips@brownstoner.com with further comments, questions or tips. Follow Brownstoner on Twitter and Instagram, and like us on Facebook.

What's Your Take? Leave a Comment