Mayor Adams Cites Need for 421-a Tax Break Replacement to Create Affordable Housing

Mayor Adams’ plan to create more “affordable” housing by converting unused office spaces into apartments hinges on reviving a controversial tax incentive for developers.

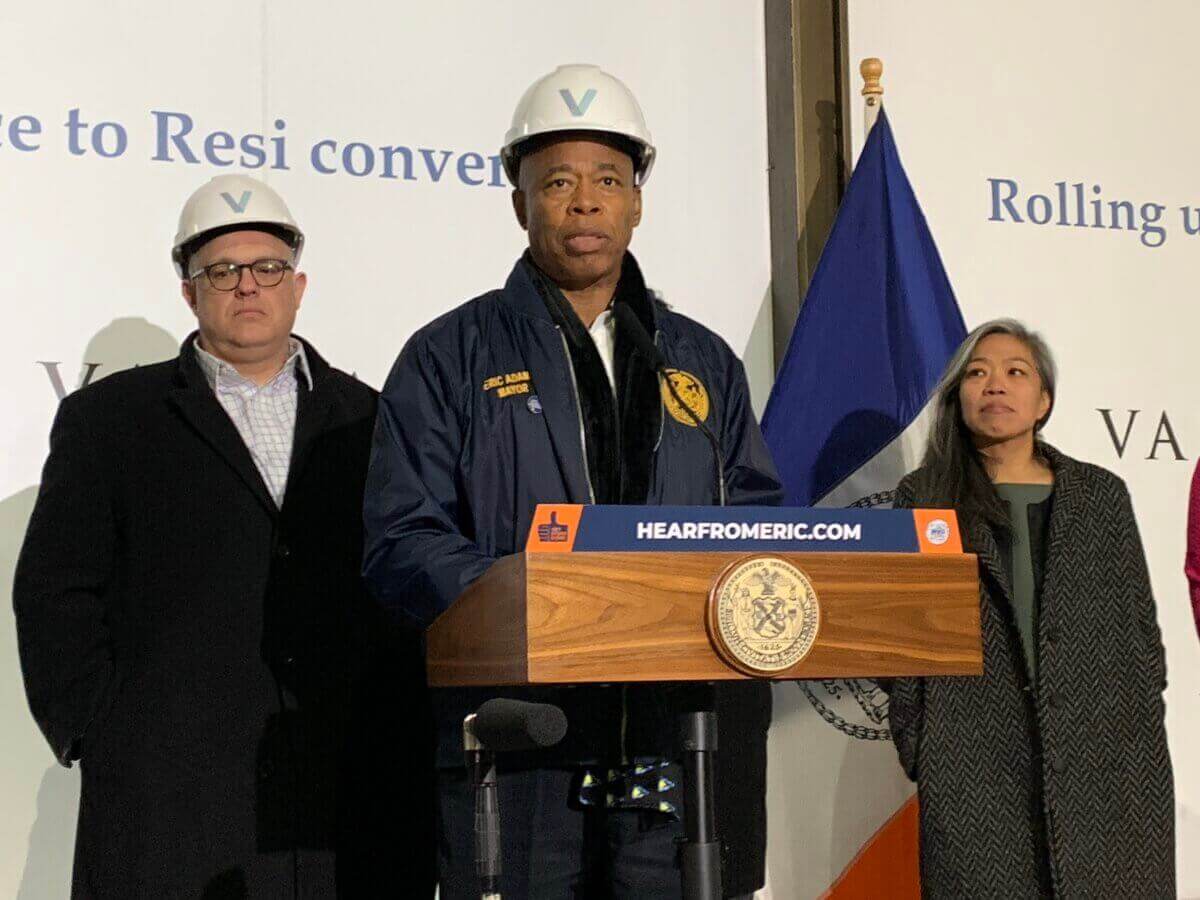

Mayor Eric Adams (center) and Deputy Mayor for Economic and Workforce Development Maria Torres-Springer (right) touring 160 Water Street, a building that’s being converted from office to residential use. Photo by Ethan Stark-Miller

Mayor Eric Adams’ plan to create more “affordable” housing by converting unused office spaces into apartments hinges on the temporary renewal and/or ultimate replacement of a controversial tax incentive for developers that lawmakers let expire last year, he said Monday.

After taking a tour of 160 Water Street — a Lower Manhattan building currently being converted from offices to 588 units of market-rate housing — Adams, during a news conference, said that, in order for office-to-residential conversions to yield affordable housing, state lawmakers and Governor Kathy Hochul need to implement either 421-a or a similar program. He called for including those items, as well as several others related to his housing agenda, in the final state budget, which must be approved by April 1.

The 421-a tax break, which incentivized private developers to build and include some percentage of income-restricted, rent-stabilized housing in their projects, was allowed by Albany lawmakers to expire last June.

“One of the most important things we can do is 421-a,” the mayor said. “It’s crucial that we get this done, even if we do a temporary version until we can hammer out the details. But we need an extension of the 421-a. This would allow construction to be completed in the existing pipeline of affordable housing projects … This is not a giveaway, this is an incentive to get more affordable housing in place. Without it, we simply will not be able to build affordable housing at the rate we need.”

Since it was first recommended by the New New York Panel in December, both the mayor and governor have been beating the drum on transforming underutilized office buildings in Midtown and Lower Manhattan, many of which have sat mostly empty since the Covid-19 pandemic popularized remote work, into residential units.

In January, Adams released the final report from the Office Adaptive Reuse Task Force — convened by the City Council. The report contained 11 recommendations to change the state’s 1929 Multiple Dwelling Law and the city’s 1961 Zoning Resolution, both of which City Hall says stand in the way of converting offices to housing.

City Council Member Justin Brannan, who passed the legislation that formed the task force and was also in attendance Monday, said if its recommendations are all implemented, the city could house up to 40,000 more families in over 20,000 new units.

“Right now we’re in really the throes of an affordable housing crisis, we’re not in the throes of an office space crisis,” Brannan said. “We have too much unused office space and not enough housing. So it’s really a no-brainer.”

The primary mechanism for making the transformations possible is changing the Multiple Dwellings Law to loosen conversion regulations for office buildings constructed between 1961 and 1990, bringing them in line with more lenient restrictions on buildings constructed before that period.

But Adams’ Deputy Mayor for Economic and Workforce Development, Maria Torres-Springer, said the conversions won’t include affordable housing unless the state enacts a new incentive program.

“So those are the two things that have to work hand-in-hand, so that as there is conversion, there’s the ability for more affordable units,” Torres-Springer said. “If we are successful with our partners in Albany, then what we’ll see is not just the conversion to residential, but also the addition of affordable units because of that tax exemption.”

During last year’s budget negotiations, the state legislature didn’t agree to Hochul’s proposed 421-a replacement and declined to extend the existing program, instead allowing it to expire. Many progressives in the state Senate and Assembly, where Democrats hold supermajorities, argued that 421-a had to go because it was a “giveaway” to private developers that didn’t yield enough truly affordable housing.

In its most recent iteration, the state tax break allowed “affordable” units aimed at households earning 130 percent of Area Median Income, or $121,420 for a household of one person. That income level is more than twice actual per capita median income in New York City. Affordable housing produced under the 421-a program was income restricted and rent stabilized but the rents that typically resulted were at or above market rate.

This year, rather than putting forward her own proposal for a new incentive, Hochul — much of whose own housing plan relies on a 421-a-like program — said she’d work with Albany lawmakers to craft a new one.

But, according to a report from City & State NY on Monday, neither the state Senate nor Assembly are likely to include an affordable housing tax incentive in their respective rebuttals to Hochul’s Fiscal Year 2024 executive budget — known as their one-house budget resolutions.

Spokespeople for the state Senate and Assembly didn’t respond to questions on whether a 421-a-like incentive would be included in their budget proposals by publication.

In response to a reporter’s question about how he’d recommend Hochul get a new housing subsidy over the finish line, given many state lawmakers’ criticisms of 421-a, Adams expressed confidence that a deal could be reached with legislators.

“As we talk about the housing crisis we’re facing, [we will] make sure that we come up with a good 421-version that we all can live with,” he said. “Do we find 100 percent agreement on anything? No you don’t. But we can find a compromise that will continue to incentivize development of affordable units. And at the same time, make sure that the price point remains affordable for low income, middle income New Yorkers as well.” — additional reporting by Cate Corcoran

Editor’s note: A version of this story originally ran in amNY. Click here to see the original story.

Related Stories

- Despite Building Boom, Housing in Brooklyn Is Not Getting More Affordable

- Pols, Advocates Wrangle Over Future of 421-a Tax Break for Development, ‘Affordable’ Housing

- What Does the New 421-a Deal Mean for Brooklyn Real Estate Development?

Email tips@brownstoner.com with further comments, questions or tips. Follow Brownstoner on Twitter and Instagram, and like us on Facebook.

What's Your Take? Leave a Comment