Court Nixes Sale of Dangler Mansion Site, Throwing Its Future Into Question

A judge said the amount offered for the Bed Stuy property was too low and the nonprofit does not seem to be properly managing its affairs as required by law.

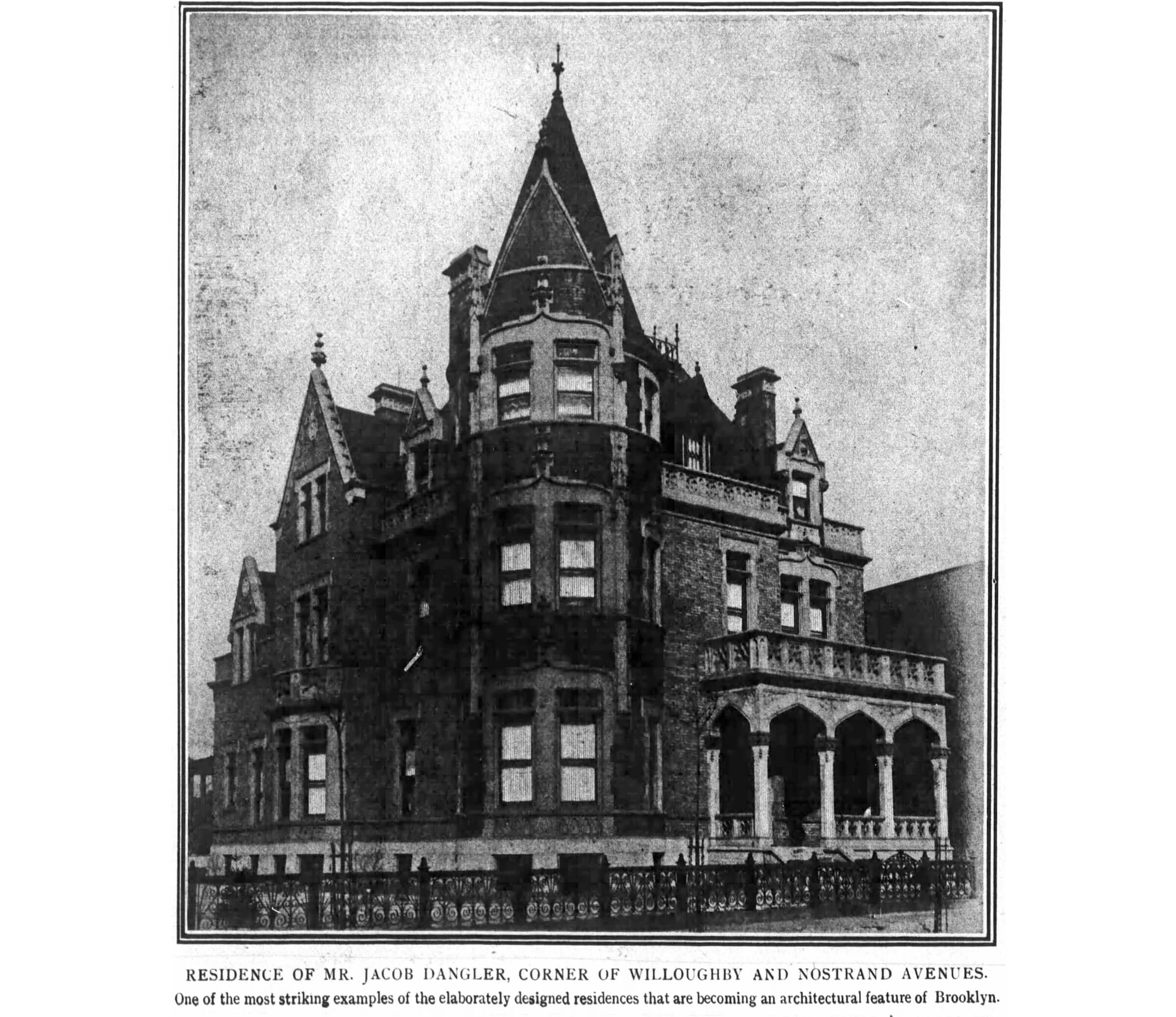

The Jacob Dangler mansion in April 2022. Photo by Susan De Vries

In a rare case of the state blocking a property sale over questionable dealings, a judge has sided with the attorney general in a long running drama that has pitted locals and preservationists against a developer and a nonprofit in Bed Stuy.

In a dramatic development, a Kings County Supreme Court judge in September rejected the sale of 441 Willoughby Avenue in Bed Stuy, the former site of the Jacob Dangler mansion, by its nonprofit owner to developer Tomer Erlich. The latter controversially demolished the historic French Gothic Revival building in 2022 as it was in the process of being landmarked.

Judge Aaron Maslow said while making his ruling on Friday, September 20, “there are serious concerns about this entire transaction,” including the amount being offered, the failure of the nonprofit United Grand Chapter Order of the Eastern Star to manage its assets, and that a so-called member had “absconded with a portion of them,” amongst other things.

In making his ruling, Maslow sided with the State Attorney General’s Office, which was arguing against the sale by calling into question the amount that had been offered by Erlich and who is really making the calls for the nonprofit.

While locals have said they want the developer to be held to account for taking advantage of a loophole in the system to demolish a building using illegal means, the judge stated at the hearing that the interests of the neighborhood were not a consideration in his decision, but rather a legal obligation to make sure charitable assets are properly and legally managed and transferred.

Through assistant attorneys general Sharon Sash and Linda Heinberg, the office argued in court that the petition to sell for $4.3 million, minus $2.098 million in mortgage debt and hundreds of thousands less for other alleged debts, was far less than what the asset was worth, and should be rejected.

Nonprofits wanting to sell property in New York must get the approval of the State Attorney General’s Office, which is in charge of overseeing the responsible handling of nonprofits’ assets including making sure transactions are fair, reasonable, and serve the interests of the nonprofit and its members. In this case, the office argued the nonprofit wasn’t living up to its responsibilities.

After reading through the dozens of documents included in the case filings and hearing from both sides’ attorneys, Maslow said his concerns also included the nonprofit had not filed appropriate returns with the IRS since 2014 and had its 501 status revoked, that its counsel hadn’t responded on time to AG’s office, and a “potential conflict of interest between the petitioner and the purchaser, considering that the same attorney represents both.”

“These concerns go towards the issue of the credibility of the case being made by the petitioner,” he said, adding another concern was that it appeared the building had been demolished “in cahoots with the purchaser.”

“This also goes towards the credibility of all of this whole transaction with this particular purchaser.”

Fighting foreclosure, fraud

In the papers filed by the United Grand Chapter Order of the Eastern Star urging the court to bypass the AG process and give the nonprofit permission to sell to Erlich, the nonprofit argued that given there was a pending foreclosure on the property, the sale would allow the nonprofit to “salvage some equity.”

The petition says the board voted to approve the sale and it attracted offers from a number of buyers, with Erlich’s offer of $4.3 million being the highest. After entering into contract to purchase the property in 2021, later that same year and with the cooperation of the nonprofit, Erlich purchased their $1.525 million mortgage debt from the lender, saying he would take it out of the $4.3 million he offered.

The petition said any profit the nonprofit makes from the sale, after debts and fees have been accounted for, will be held in escrow and will go towards a replacement property. In the meantime, the nonprofit said it will use the building at 197 St. James Place in Clinton Hill, which is owned by its parent entity The Hiram Grand Lodge of Ancient Free and Accepted Masons.

“To the best of the Corporation’s knowledge, the consideration and terms of the Sale Agreement entered into is fair and reasonable to the Corporation,” the petition says. “The sale will provide the Corporation — which is financially strapped — to pay all fees, taxes and closing costs plus indebtedness owned by the Corporation and leave enough money to acquire another premise suitable for the use of the Corporation.”

While the petition to sell the property has been unfolding in Kings County Supreme Court, the nonprofit has also been fighting a foreclosure action on the property in the same court in front of a different judge, which was started by the lender Advill Capital LLC in 2020.

After Erlich took over the mortgage debt in 2021, he also took over as the plaintiff in the foreclosure lawsuit, which he is continuing to fight against the nonprofit. In that case, the nonprofit argues the mortgage debt bought by Erlich isn’t valid because it was taken out fraudulently by members without the authority to do so.

However, the nonprofit says in the petition to sell the property to Erlich that the court might find the debt enforceable and that is why it is seeking permission to sell.

“If this sale is not timely approved there is a high likelihood that the entire value of the property may be lost to foreclosure since petitioner will have no ability to pay the unpaid balance of the consolidated mortgage and will not be able to find another buyer and obtain Supreme Court approval in time to avoid a foreclosure sale,” the petition argues.

Foreclosure could see nonprofit get more money

At the recent hearing, Sash argued that foreclosure was not normally “a preferred route” for a nonprofit property, but she said given the concerns about the price being offered in the sale and mismanagement of the organization, the sale shouldn’t be allowed to go ahead.

On top of reducing the $4.3 million offer (which the AG’s office calls “inadequate”) with the mortgage debt, Sash said Erlich is also looking to reduce it with the demolition costs, lawyers’ fees, a broker’s fee, and other debts, totaling $3.69 million, which she said was unjustified. That would leave the nonprofit with around $600,000.

She said the AG’s office had done its own appraisal of the property when the Jacob Dangler mansion was still standing, which had valued it at $6.25 million, nearly $2 million more than what the nonprofit said its appraisal was. Following the demolition, the AG’s office had another appraisal done which came in at $5.4 million, while the nonprofit’s second appraisal post-demolition was $4.8 million, court documents show.

“Our appraisal demonstrates that whatever they claim they’re getting for the property is not fair and reasonable,” Sash said, adding that was even before all of the reductions for alleged debts and fees.

Another wrinkle is that the nonprofit’s appraisals were not handled independently as required by law, court filings show. The first one was commissioned by Erlich, and its second by an attorney shared by the developer and the nonprofit.

Sash said normally foreclosure isn’t viewed as a great result, but said there isn’t any proof in this situation that the nonprofit would be worse off if the property goes to foreclosure. Under the law, the AG’s office can only approve a sale of a charitable asset if the offer “is a fair and reasonable consideration” and the sale serves “the best interests of the members of the organization,” Sash said. The valuation is just one of a “multitude of reasons why this petition should be denied,” she added.

Sash said the revocation of the nonprofit’s tax exempt status due to not filing returns since 2014 and a history of fraud and mismanagement by insiders were also of serious concern. Court documents say the nonprofit chapter that owns 441 Willoughby “appears to be a dormant organization” and allege there is an “ongoing failure by its Board and officers to properly administer its charitable assets, including the Property, or act in accordance with law.”

Also of concern, she said, is that lawyers for Erlich are also representing the nonprofit in the sale, which she said is a conflict of interest and means the nonprofit isn’t getting independent advice. “Its leadership, whatever that is, has failed to adhere to the most basic fiduciary obligations of running a not for profit in the state of New York,” she told Maslow.

AG alleges poor governance

In the simultaneous foreclosure case, the AG’s office says in court filings that Erlich is fighting “to wipe the petitioner out financially, while the same parties also seek approval of a sale of the Property for a below market purchase price that would be further reduced by the Purchase Price Set-Off.”

Another thing the AG’s office takes issue with is the record of offers for the property presented by the nonprofit, saying there is no evidence the property was actually marketed, and that Erlich is charging the nonprofit a $129,000 broker’s fee, despite the contract of sale saying there was to be no such fee.

According to the court documents, that fee is going to Christopher Fenelus, who spoke on behalf of the nonprofit at a July 2022 meeting as the assistant treasurer of the Most Worshipful Hiram Grand Lodge Fraternal Society Incorporated. His LinkedIn also has him listed as a real estate broker.

He told Bed Stuy locals at the 2022 gathering that selling the building was not what the organization had wanted, but it was a necessity for its financial viability. At the time, residents in the neighborhood were fighting to landmark the property. They were dismayed when it was demolished during the landmarking process, and locals remain largely opposed to the sale.

The property attracted a lot of interest from developers, Fenelus said at the 2022 meeting, and the contract price was “much more” than the amount owed on it, which he said the nonprofit would use for its community charity and making needed repairs to its second location at 197 St. James Place in Clinton Hill.

“As there is no evidence whatsoever that Mr. Fenelus did any “brokering” of the property, the court should not permit proceeds to be used for such a payment,” the court documents state.

Sash added that there is currently a petition before the AG’s office to sell 197 St. James Place, which court documents say “is uninhabitable and dilapidated.”

“It is unlikely that petitioner is currently operating out of that space, and since petitioner’s own property was demolished in July 2022, it is likely petitioner has not engaged in charitable activities for quite some time,” court documents allege.

The nonprofit did file forms with the IRS this year for the first time in a decade and said in those forms that between 2017 and 2020 there had been “a significant diversion of the organization’s assets.” According to the documents in the foreclosure case, the fraudulent mortgages were taken out in those years and the nonprofit has no idea how the funds were used, as there had been no record keeping.

“In other words, petitioner’s accounting, record keeping, and governance were and continue to be so poor that it cannot state whether it received the funds or for what purposes any funds were used, but also now requests that those amounts be deducted from the purchase price for the Property,” the AG’s office argues in court documents.

Sasha also noted that there had been no explanation from the nonprofit about why it had allowed the Dangler Mansion to be demolished or how that furthered the charities’ mission, and added the permit falsely lists 360 Brooklyn LLC as the “owner” of the property.

Brownstoner reached out to the Department of Buildings regarding the name on the permit, and a rep said DOB doesn’t “confirm ownership information when reviewing work permit applications.”

“If the owners of a property believe that someone has applied for work permits without their permission, and they would like to put a hold on the proposed work, they should notify DOB about their concerns. The owners of 441 Willoughby Avenue have not notified DOB of any concerns with the application to demolish the former building at the site,” the rep said.

Permit applicants must sign a statement when applying for a permit that acknowledges falsification of statements is a misdemeanor and punishable by fines or imprisonment and an applicant can be barred from applying for further permits if found guilty.

Future unclear as foreclosure appealed

Attorney Shveta Kakar of law firm Fox Rothschild, who is representing the United Grand Chapter Order of the Eastern Star in the case, told Maslow that the nonprofit is “very much alive” and is an all female Masonic lodge that has a male counterpart.

She said as an experienced nonprofit lawyer she regularly saw nonprofits who did not file the correct forms with the IRS and had their status revoked and it wasn’t at all unusual. She said as well there is nothing stopping the AG from investigating the nonprofit after the sale, but right now it is facing an “existential crisis” and needs the sale in order to survive.

In court documents, Kakar says pursuing those responsible for the alleged mortgage fraud “is simply not feasible.”

“For the AG to continue to press that issue is fanciful. Doing so would be enormously expensive and almost certainly fruitless,” the petition states. “The overwhelming likelihood is that these ill-gotten proceeds have long since been spent and not recoverable. It’s not as if the fraudsters placed these funds in an escrow account.”

In regards to moving forward with the sale, she argued it is a necessity for the organization “because the alternative, as you said, is a foreclosure that it’s facing.”

“The fact that they are more concerned about the community, as opposed to the charitable organization, is astounding,” Kakar argued. Maslow refuted that, saying it sounded like the AG’s office primary concern is the charitable organization and its assets rather than local residents. “After all, this is all tax free money.”

Maslow said rejecting the sale and allowing the property to possibly go to foreclosure is “rolling the dice” on how much the property would attract, but said given the property’s location and the fact the current offer isn’t adequate the rejection is justified.

Earlier this year, Judge Lawrence Knipel said the nonprofit had waived all its defenses in the foreclosure proceedings by signing an estoppel certificate with Brooklyn 360 LLC, ultimately ruling that the foreclosure sale could go ahead. The nonprofit, through the Law Office Of Anthony W. Vaughn, Jr. LLC, filed an appeal that is still ongoing.

In their arguments against the foreclosure, the nonprofit alleges that members Toni Watson and Connie Green “conspired and acted in concert” to take out mortgages on the property for their personal gain, and “fraudulently amended United Grand’s bylaws in order to appoint Paul Alvarenga as an officer of United Grand.” The trio went on to take out more than $1.5 million in mortgages, the nonprofit alleges.

The organization does not appear to have attempted to pursue criminal charges against either. Brownstoner reached out to Erlich and the Law Office Of Anthony W. Vaughn, Jr. LLC, but did not hear back by the time of publication.

Despite the ruling striking down the proposed sale, Erlich could still wind up the owner of the property. If he is able to foreclose, a foreclosure auction will be required. The debt holder, in this case Erlich, can bid, and the highest bidder will become the new owner, paying off any mortgage debt. If any proceeds are left after any fees allowed by the referee, the nonprofit can take action to receive them.

While no new-building permits have been filed for the lot, Erlich said in 2022 he intended to build a 44-unit, seven-story apartment building, which could be developed as of right in the R6A zoned area. PropertyShark says a 30,000 square foot building is allowed.

While some owners might contemplate a rezoning, such an option might be less likely in light of the recent landmarking of the adjacent blocks.

A new owner could also try to flip the property to another developer, if they can sell at a profit.

Related Stories

- Locals Celebrate Creation of Bed Stuy’s Willoughby-Hart Historic District

- What’s Happening With the Empty Lot in Bed Stuy Where the Dangler Mansion Once Stood?

- Preservationists Hope New Landmarks Rules Will Better Protect Historic Buildings, Prevent Demos

Email tips@brownstoner.com with further comments, questions or tips. Follow Brownstoner on Twitter and Instagram, and like us on Facebook.

What's Your Take? Leave a Comment