As Covid Protections End, Brooklyn Foreclosures and Homelessness Poised to Grow

As homeowners struggle to recover from a loss of work or income brought on by the Covid-19 pandemic, mortgage default rates could be nearing, or even overtaking, those seen after the 2008 financial crisis.

Photo by Susan De Vries

As homeowners struggle to recover from a loss of work or income brought on by the Covid-19 pandemic, mortgage default rates could be nearing, or even overtaking, those seen after the 2008 financial crisis, a supervising attorney at The Legal Aid Society told Brownstoner.

More than 1,000 pre-foreclosure notices, also known as lis pendens, have been filed against homeowners in Brooklyn since the start of 2022, when a foreclosure moratorium — enacted due to the devastating effects of the Covid-19 pandemic — came to an end.

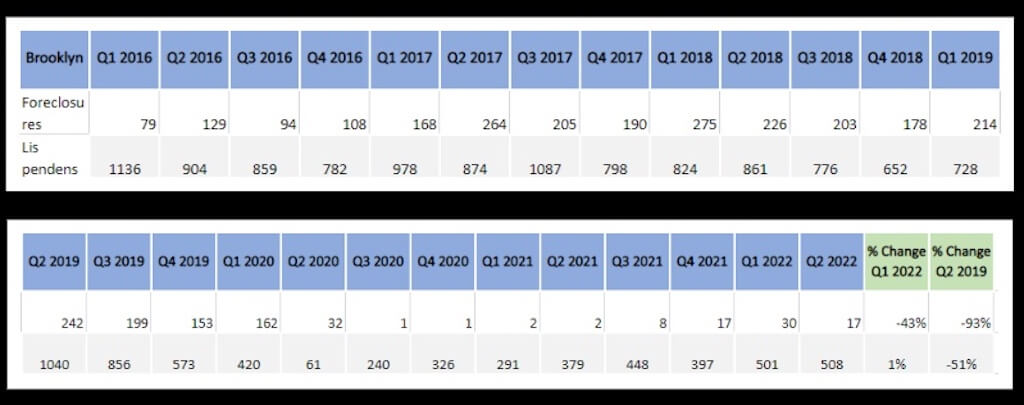

In the first three months of the year, 501 pre-foreclosure notices were filed on individual co-op and condo units, and townhouses with one, two or three units in Brooklyn, while 30 actual foreclosures took place, according to data compiled by PropertyShark. Then, between April and the end of June, another 508 lis pendens were issued and 17 properties were foreclosed on. Brooklyn is typically the borough that experiences the most foreclosures citywide, but the latest PropertyShark data shows 124 of the 199 foreclosures that took place over the past three months were in Queens.

Citywide, there have been 286 foreclosures this year, compared to 811 over the same period in 2020, just prior to the foreclosure moratorium. In Brooklyn, there were just 29 foreclosures during 2021, the only full year of the moratorium, compared to 808 in 2019, before the pandemic hit.

Despite the increase in lis pendens, the number of actual foreclosures is still drastically down compared with pre-pandemic levels, thanks to pandemic restrictions. “The eviction moratorium was the biggest factor in minimizing and nearly completely eliminating foreclosures,” PropertyShark Senior Writer Eliza Theiss told Brownstoner. Due to the time-intensive nature of the foreclosure process in the city, she added, cases could increase in the coming months.

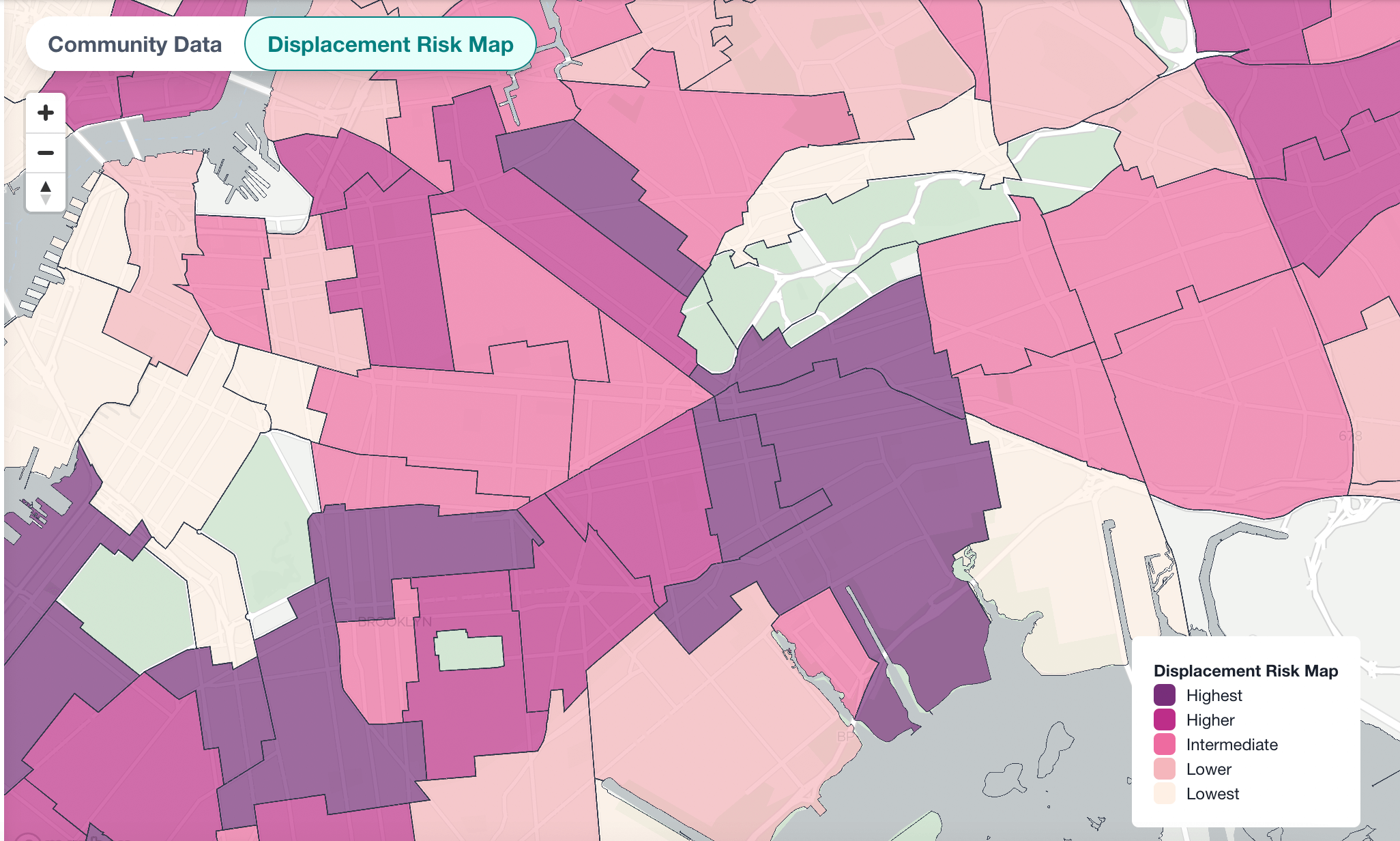

The Brooklyn properties that have been foreclosed on this year were spread across the borough, with the highest concentration in the 11207 ZIP code, which covers parts of East New York and Bushwick, where there were three. According to city data, residents in parts of East New York, Cypress Hills, Brownsville and Bushwick face some of the highest risks of displacement citywide. In East New York, the median income is below the citywide median household income at $41,564, and just 25 percent of residents own their homes. In Bushwick, that number is even less at 14 percent.

Despite the moratorium being in effect through 2021, there were still 1,515 lis pendens filed against Brooklyn homeowners that year and 29 homeowners were foreclosed on. According to Theiss, the foreclosures that took place during the moratorium were mostly the result of common charge liens — which occur when the owner of a condo or co-op unit fails to pay a common monthly charge for several months in a row — not mortgage liens.

The number of lis pendens is typically many times higher than actual foreclosure filings. Due to the fact there were nearly 30 times as many lis pendens as foreclosures between April and July this year, the number of foreclosures could grow over the next quarters, Theiss said.

“It also must be kept in mind that a home that has entered pre-foreclosure can avoid the auction block through several approaches and many are indeed handled before they enter foreclosure,” Theiss said.

Foreclosures occur when a homeowner defaults on their mortgage or other payments, and a lender sells the property to recoup the debt. Sometimes the result of predatory practices such as subprime lending and deed fraud, pervasive in central Brooklyn, foreclosures exacerbate homelessness and housing insecurity, something widely seen following the 2008 financial crisis.

Oda Friedheim, a supervising attorney in The Legal Aid Society’s Foreclosure Prevention Unit, told Brownstoner that while she didn’t have an exact number, delinquencies across the city are generally up. “Some say that mortgage defaults exceed those that occurred in 2008 after the crash. Based on what I note in speaking to struggling homeowners, many are still recovering from the loss of employment and or reductions in hours as a result of Covid.”

Friedheim said that while many homeowners were granted a forbearance through the CARES Act, most are not able to resume their prior mortgage payments and are dealing with recalcitrant mortgage lenders or their servicers in obtaining a loan modification.

Ivy Perez, the policy and research manager at Center for NYC Neighborhoods, added that the end of Covid relief measures and the increasing cost of living were adding to homeowners’ financial issues.

“The challenges can really just pile on top of each other,” Perez said. “I’m particularly worried about the rising housing prices, they make the properties so attractive to people coming in. That makes homeowners particularly vulnerable, especially if they’re experiencing existing pressure – there are a lot of interests that want your home that you are struggling to keep.”

She said many of the programs designed for eviction prevention were funded through the city and state and she worried that funding would dry up as Covid left the spotlight, saying issues for homeowners can continue to stick around for years and years – especially if they are in court. Rising housing costs and inflation only add to homeowner pressures, she noted.

Perez said it is vital the city and state keep up with funding foreclosure prevention resources, which can include legal services, monetary assistance and housing counseling, all of which CNYCN provides as an anchor partner of the state-run Homeowner Protection Program.

What's Your Take? Leave a Comment