Brooklyn Has One of the Lowest Homeownership Rates in the U.S., Study Discovers

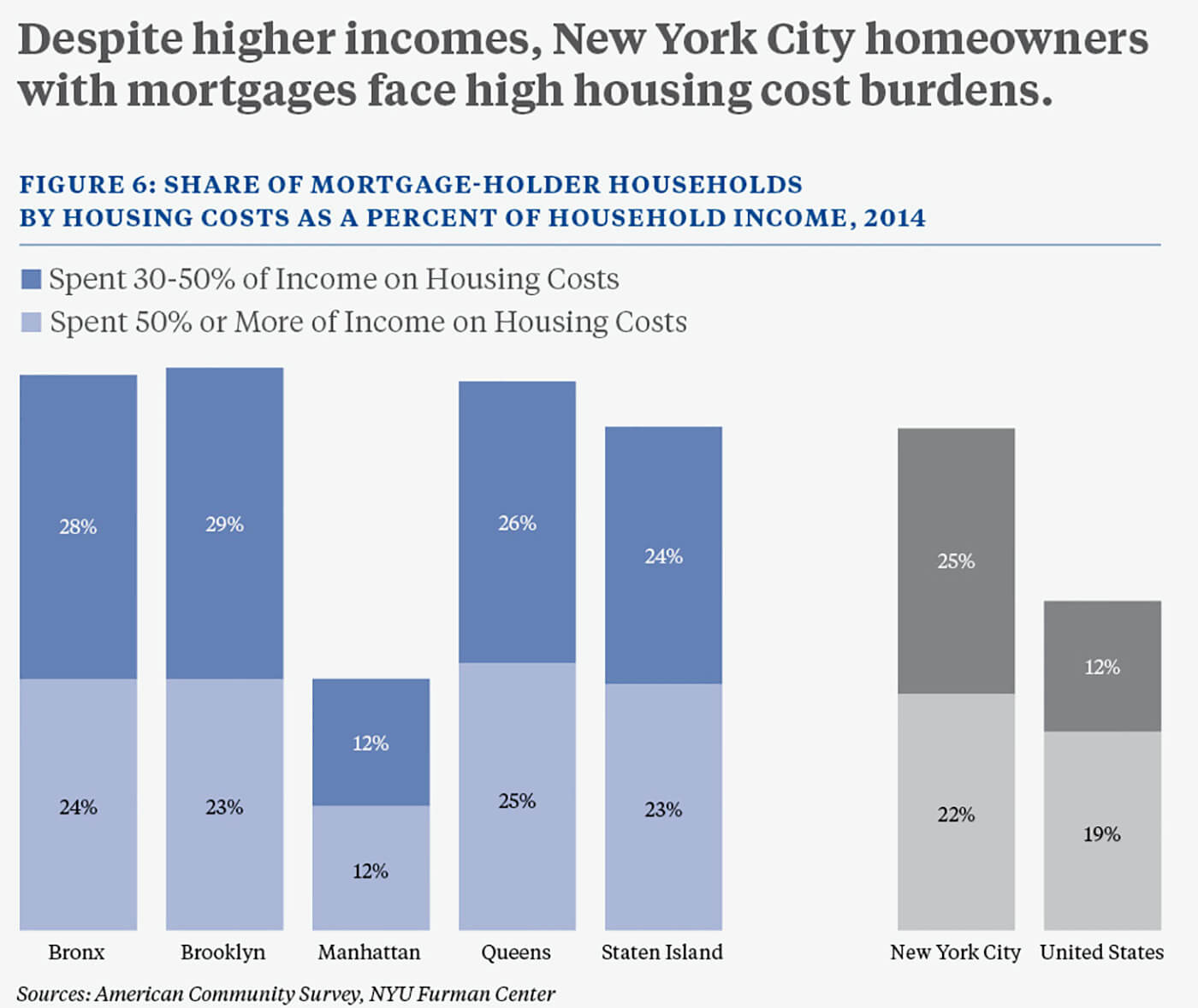

A new report by the NYU Furman Center found Brooklyn has the fourth-lowest homeownership rate of all U.S. counties. And of those who do own their own home in Brooklyn, 29 percent were found to be “severely cost burdened” — aka house poor.

Brownstones in Brooklyn Heights. Photo by Barbara Eldredge

A new report by the NYU Furman Center found Brooklyn has the fourth-lowest homeownership rate of all U.S. counties. And of those who do own their own home in Brooklyn, 29 percent were found to be “severely cost burdened” — aka house poor.

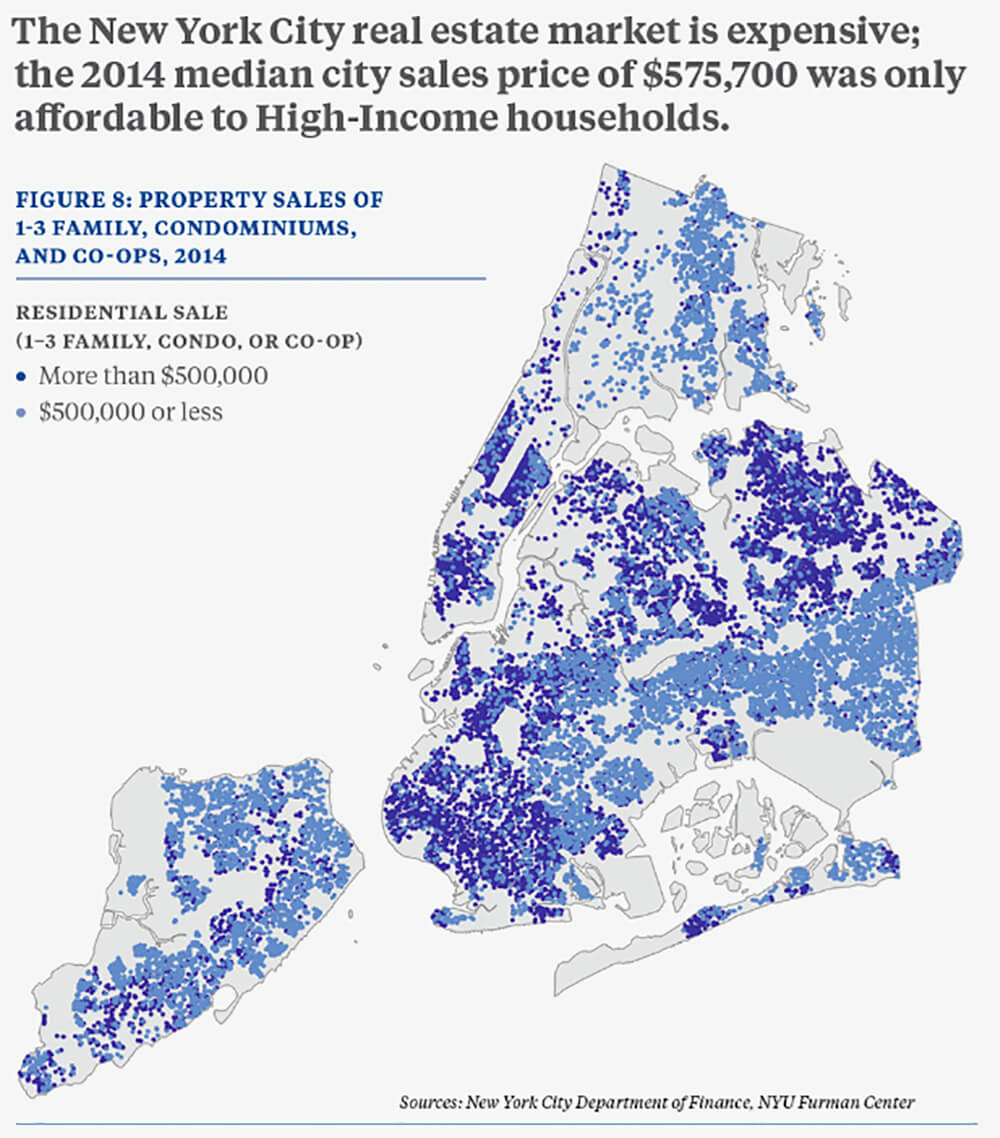

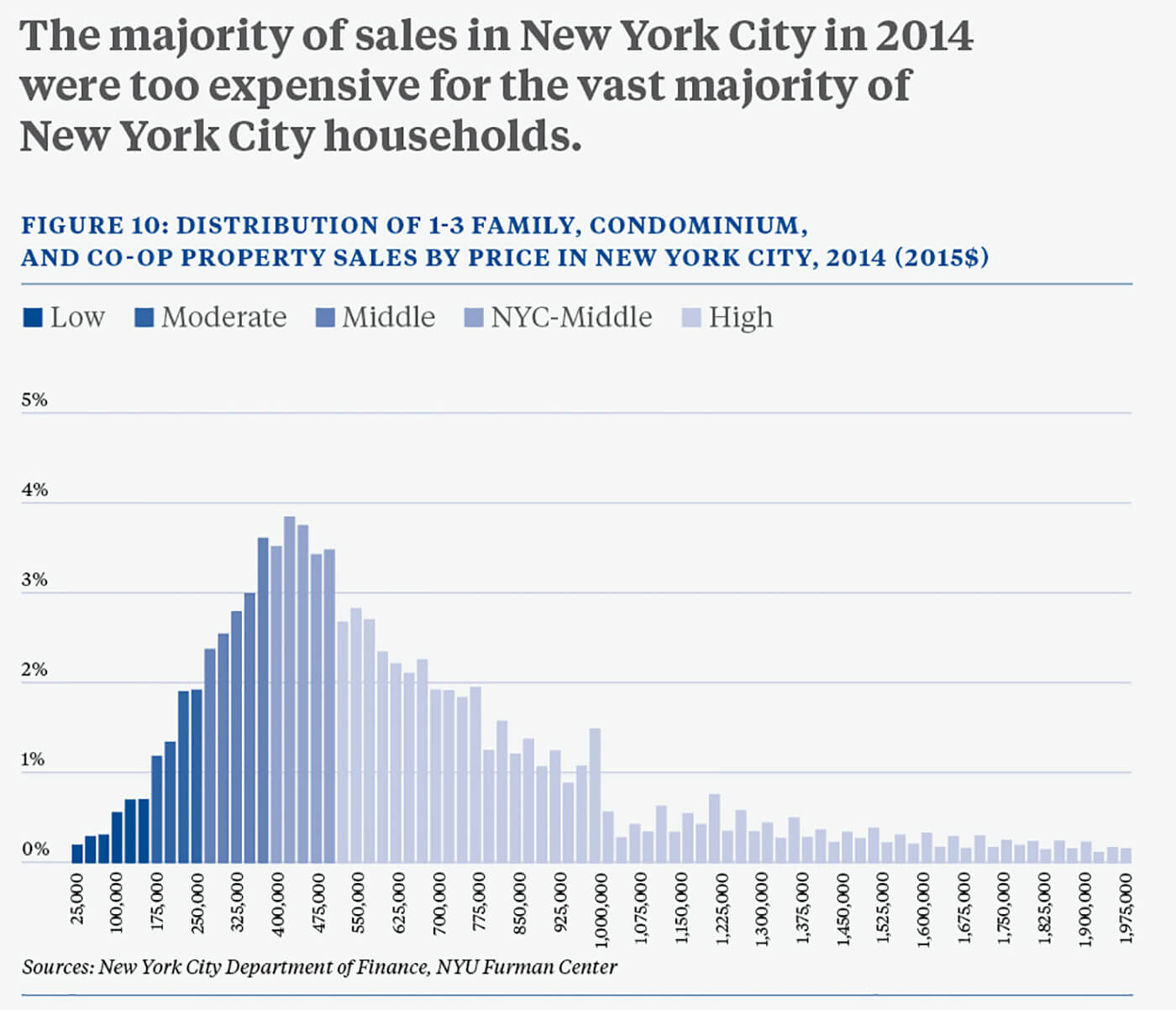

As one might expect, home ownership in New York City overall is affordable only to high-income households. Most residential sales in the area were out of reach for the “vast majority.” The report said:

Households earning up to $114,000 (comprising 77 percent of New York City households) could only afford 42 percent of 2014 home sales in New York City. Households earning to $83,000 annually (comprising 66% of New York City households) could only afford 22 percent of 2014 sales in New York City.

Manhattan had the lowest rates of homeownership, followed by the Bronx. The picture wasn’t much better in Westchester County. But over in Staten Island, rates of homeownership were relatively high and exceeded the U.S. average.

“The homeownership rate in Staten Island exceeded that of the U.S. with a rate of 68 percent in 2014 — five percentage points higher than the national homeownership rate,” found the report.

In Brooklyn, home ownership has been on the upswing in recent years. “Between 2000 and 2006, Brooklyn’s homeownership rate increased five percentage points,” according to the Furman Center.

High income was defined as over $114,000, or 165 percent of area median income. For the 51 percent of city households who annually earn $55,000, only 9 percent of 2014 home sales were affordable, and even for households earning up to $114,000, fewer than half of home sales were affordable, according to the report.

The reason for New York City’s historically low ownership rates vs. elsewhere in the U.S.? High prices and low incomes, according to the report. “We find that the purchasing power of most New York City households is limited, largely due to growing housing prices and stagnating incomes since 1990.”

More than 50 percent of Brooklyn homeowners with a mortgage were found to be house poor, with 29 percent spending 30 to 50 percent of their income on housing and 23 percent spending more than 50 percent on housing, the report said.

The demographic picture is varied. Asians constitute the largest demographic of Brooklyn homeowners, at 39 percent. Whites come in a close second, at 36 percent. Blacks make up 25 percent of homeowners, and hispanics constitute the smallest percent of Brooklyn homeowners, at 15 percent.

Condominiums represent a relatively affordable buying opportunity for low-income households, according to the report. “Of the sales affordable to households earning up to up to $34,000 annually, a large share (37 percent) were condominiums.”

Related Stories

- Does House Flipping Make Brooklyn Less Affordable?

- How to Buy a Home — Readers Sound Off on Affordability and Gentrification

- From Redlining to Predatory Lending: A Secret Economic History of Brooklyn

Email tips@brownstoner.com with further comments, questions or tips. Follow Brownstoner on Twitter and Instagram, and like us on Facebook.

What's Your Take? Leave a Comment