What Is a Co-op Maintenance Fee?

If you own a co-op or are thinking of buying one, expect to pay a pretty hefty maintenance fee every month.

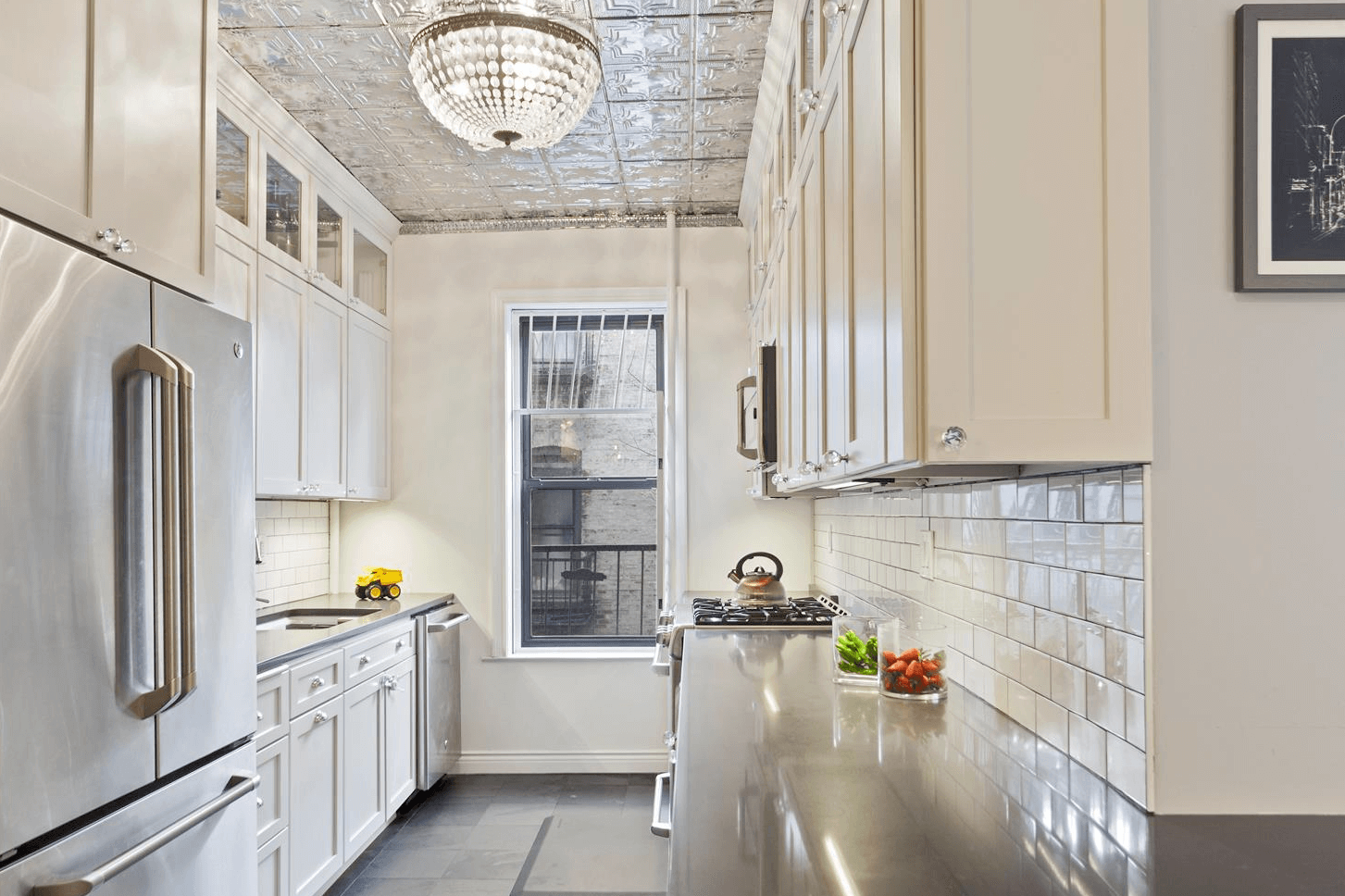

Interior of a Cobble Hill co-op. Image via Brown Harris Stevens

When you own a home, there can be a lot of expenses in addition to the mortgage. If your home is a co-op, expect to pay a pretty hefty maintenance fee every month.

What exactly is a co-op maintenance fee, and why are they often more expensive than condo common charges?

The monthly maintenance covers the shareholder’s portion of the operating expenses and property taxes for the building. (If the co-op has an underlying mortgage for the building, that will also be included.)

A condo, on the other hand, separates these two items into taxes and common charges.

The reason for the variation has to do with the difference between condos and co-ops.

Condos are real property, and each condo has its own tax lot. When you buy a co-op apartment, on the other hand, you are technically buying shares in a corporation, not real property. Your ownership shares entitle you to a proprietary lease, which gives you the right to reside in the apartment.

An entire co-op building is one tax lot, so the shareholders must divide the total tax bill according to the number of shares they own. The units are not taxed individually.

This is why co-op maintenance, which combines taxes and building expenses together, is not the same as a condo common charge, which separates them.

Brown Harris Stevens real estate broker Eileen Richter breaks down the situation:

“A co-op has a “maintenance fee,” which combines your portion of: a) the taxes on the building (which provide you with a certain amount of tax deductibility); b) common costs to run the building; and c) heat and hot water (usually included for coops, though there are exceptions).”

Be sure to factor in the maintenance when you calculate your monthly expenses and what you can afford. In some co-ops, you may be able to afford the purchase price, but not the maintenance — or not the combined costs of the mortgage and maintenance.

Your real estate attorney, also, will advise you whether the maintenance fee is reasonable given the other attributes of the building, such as its size and reserve fund.

Also keep in mind the co-op board is likely to require a buyer have six months to two years of maintenance fees in reserve in the bank after closing.

“Potential purchasers for a co-op will need to submit an application for approval by the co-op board that shows that they can support not only the purchase but also the maintenance costs and any other financial liabilities that they sustain and still have “post-closing liquidity,” Richter explains.

Requirements will vary from building to building, Douglas Elliman associate broker Myrel Glick comments.

“Some buildings want to see at least two years of reserves, which is two years of a buyer’s monthly living expenses in the apartment. Buyers must have funds in reserve after closing — some co-ops require, for example, six months of maintenance payments. Others require more.”

Related Stories

- What Is a Co-Op Apartment: Everything You Need to Know

- How to Buy a Co-op Apartment in NYC: Here’s How the Process Works

- From the Forum: Worth It to Convert a Brownstone Into a Condo or Co-Op?

Businesses Mentioned Above

Email tips@brownstoner.com with further comments, questions or tips. Follow Brownstoner on Twitter and Instagram, and like us on Facebook.

What's Your Take? Leave a Comment