Buying an Apartment? Here’s What You Need to Know About Insurance

A broker with local knowledge can help translate the requirements of co-op boards and condo boards, which can vary.

You have to get apartment insurance in order to close on your dream apartment, but there’s a lot of fine print, which none of us read — so here are a few things to ask your broker:

1. Does it affect my insurance cost if I renovate immediately rather than waiting?

If you are painting or refinishing a floor over a few weeks at a cost of, say, $5,000, probably not. But replacing a kitchen and bathroom over six months, yes. Many standard policies are voided by more extensive renovation work. Best bet? Ask your broker.

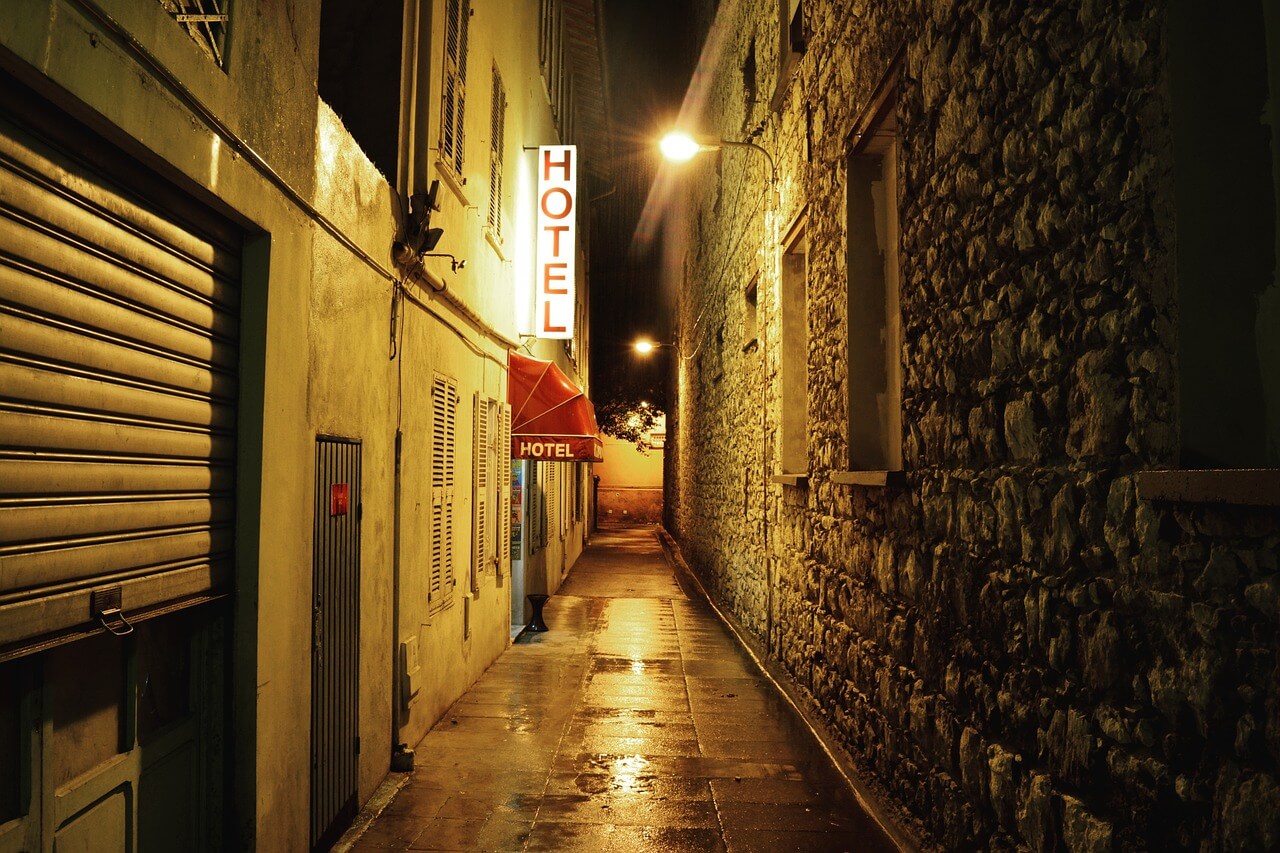

2. What if I’m forced to move out for a while due to damage in my home?

Most policies will pay for you to stay in a hotel or rent a temporary location while you are under repair from a covered loss — it’s called loss of use or additional living expenses (ALE). There’s usually a dollar limit or a time limit or both, so talk to your broker.

3. Is there a difference in cost and coverage between a co-op and a condo?

There is not, but a broker with local knowledge can help translate the requirements of co-op boards and condo boards, which can vary.

Gotham, New York City’s No. 1 apartment insurance broker (based on Yelp reviews), has been providing exceptional service to New Yorkers for over 50 years.

Just fill out the quick form, give them a call at +1 (212) 406-7300 or shoot them an email at info@gothambrokerage.com.

[Photos via Unsplash and Pixabay]

What's Your Take? Leave a Comment