When Shopping for Insurance, a Condo or Co-op Board Checks These 3 Boxes

When co-op associations are choosing insurance carriers, must-haves include directors and officers liability insurance.

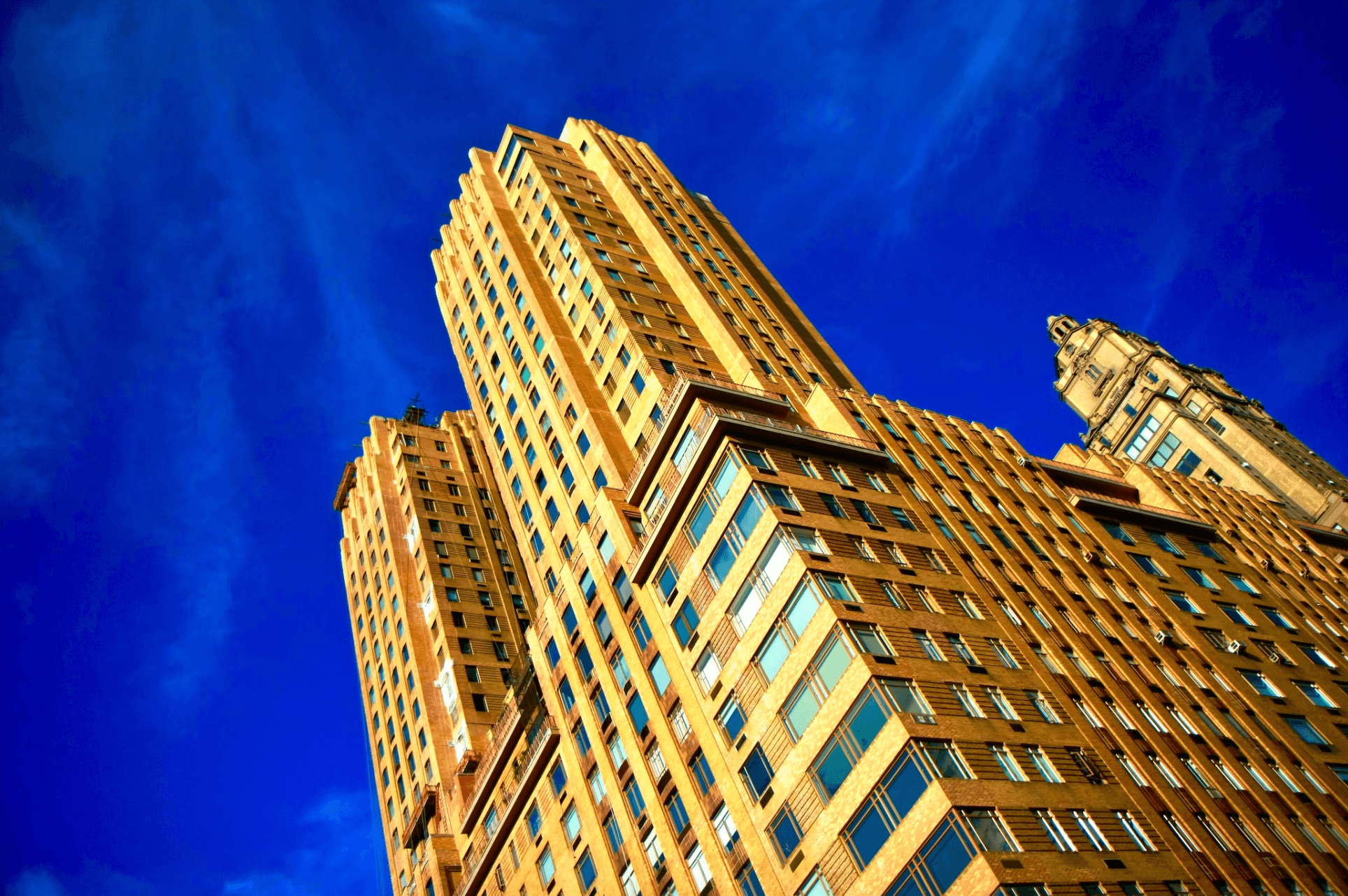

Photo via Getty

A condo or co-op board is elected to run the daily business and make most of the decisions for the general operation of the building, including buying insurance. Here’s how they make the right choice:

1. The price is right

Price is one aspect that a co-op or condo board shouldn’t overlook. Brownstone Agency makes an offer that’s hard to refuse: a three-year prepaid policy that allows the building to lock in this year’s rate — and not see an increase for three years.

2. The policy has directors and officers liability insurance

Directors and officers liability insurance (D&O) protects the personal assets of condo and co-op board members in the event they are personally sued by residents, employees, vendors, investors, or other parties. Without D&O liability insurance, board members would need to hire their own lawyers to defend themselves.

3. The service is stellar

Brownstone Agency has condo and co-op associations that have been clients for 50 years. The Brooklyn office is like a family affair. Clients come in for a coffee and get whatever they need for their insurance: increase their limits, decrease their deductible, etc.

And Brownstone Agency handles claims on behalf of the carrier — a true one-stop shop.

To protect your condo or co-op board members, to inquire about locking in a low rate with their three-year prepaid policy, or if you’re managing a townhouse or apartment building, reach out to Brownstone Agency today.

[Photos via Unsplash unless noted otherwise]

What's Your Take? Leave a Comment