3 Red Flags That Might Jeopardize Your Chance of Getting a Home Mortgage Loan

In the mortgage lending business in Brooklyn for 16 years, Adam Dahill has seen all sorts of snafus that can prevent buyers from getting a mortgage.

Adam Dahill, ranked in the top 1 percent of mortgage originators in the U.S. since 2014, is a loan officer at Citizens Bank. In the mortgage lending business in Brooklyn for 16 years, he’s seen all sorts of red flags that can prevent buyers from getting a mortgage.

Here are three of them:

1. The buyer says the property will be used as a primary residence when it won’t.

An investment property requires more money down — 25 to 30 percent at times as opposed to 20 percent or less — and there’s a higher interest rate.

“Interest rates are based on risk. If you’re not living in the home, there’s a higher rate of default,” says Dahill. “This is how the bank thinks: If you have two houses, and you lose your job, you’ll pay your primary mortgage rather than the investment property.” Statistically, non-owner-occupied mortgages default at a higher ratio than owner-occupied mortgages

As a result, some buyers will say they’ll be using the property as a primary residence, getting more favorable payment terms.

Dahill says that owners of investment properties are depending on rental income to make their mortgage payment. If the tenant doesn’t pay their rent, the owner won’t pay the mortgage until they get the money from tenant.

“If the bank thinks you’re not being truthful when you say you’ll be living in your new home, they’ll deny you a mortgage,” he says. “They’re very vigilant about occupancy fraud.”

2. There’s money coming from other places — family members or friends — that the buyer tries to hide.

It’s very common for a buyer to receive money from a family member to make a down payment on a property. But it needs to be specified as a gift — not a loan.

“Banks will look back 60 days into your accounts to make sure there’s consistency,” says Dahill. “If they see a $25,000 deposit, they need to know if it’s a gift or loan.”

Without a gift letter from your family member, a bank can deny you a mortgage. “They need to know how much you’re spending every month,” he says.

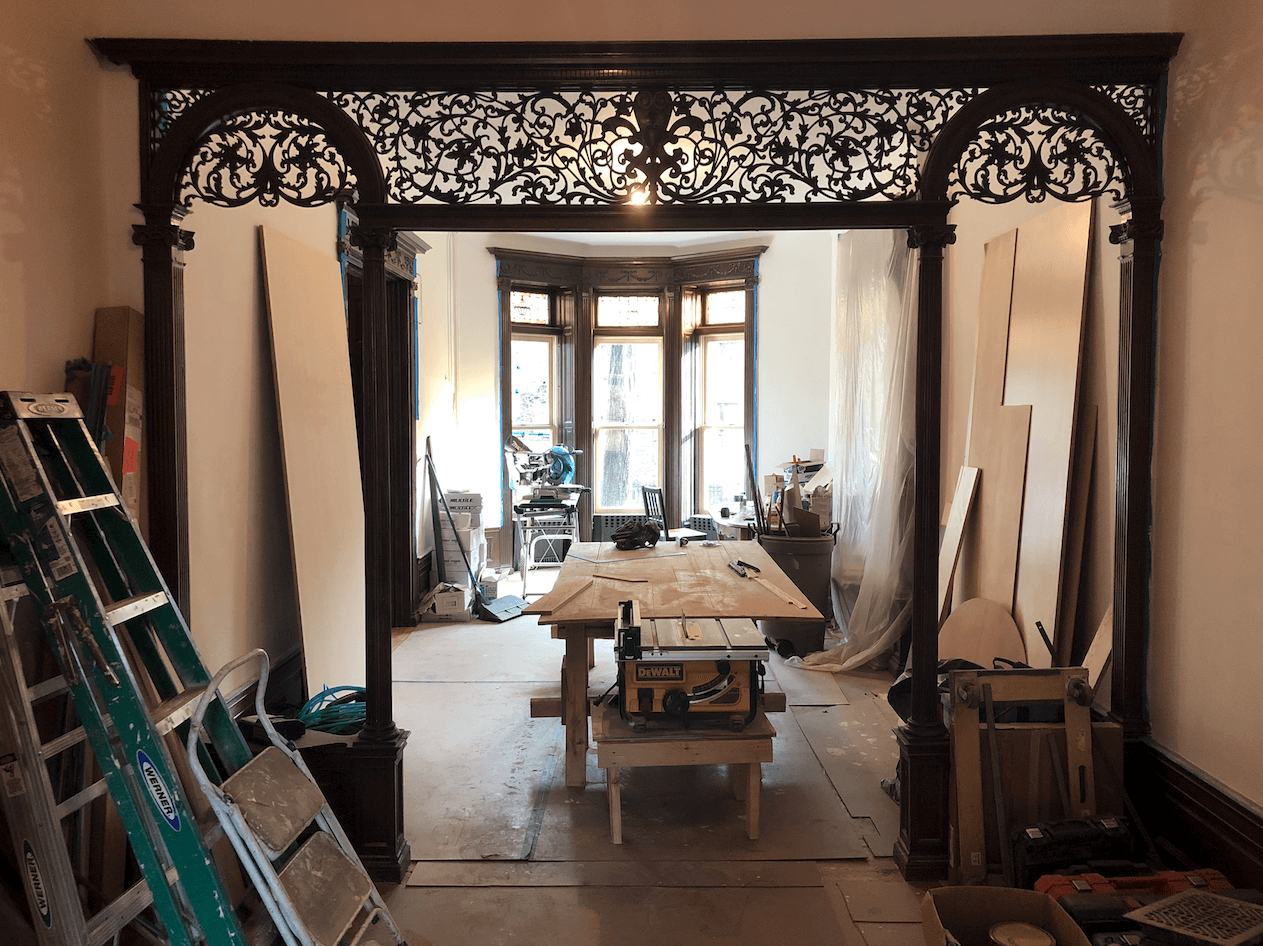

3. You’re applying for a loan and there are open permits for work on the property.

This is especially important if you’re refinancing to get a lower interest rate or to draw money to do renovations on an existing property.

When doing a title search, you might get stung by an open permit. For example, say you receive the go-ahead from the building department to build a 10 by 10 foot extension but you build a 20 by 20 foot extension instead. The DOB won’t sign off on — or close — the permit.

“Banks require permits to be closed,” says Dahill. “Banks don’t want to take back the house if you default. They don’t want to fix things. They want those permits closed, so talk to your loan officer and see what kind of title searches they require.”

For information on a home or refinance loan, visit Dahill’s website here.

What's Your Take? Leave a Comment