Open House Picks

Brooklyn Heights 169 State Street Stribling Sunday 12-2 $2,495,000 (was $2,995,000) GMAP P*Shark Park Slope 438 7th Street Brooklyn Properties Sat & Sun, 1-3 $1,950,000 GMAP P*Shark Prospect Heights 270 Sterling Place Corcoran Sunday 1-3 $1,500,000 (was $1,500,000) GMAP P*Shark Bedford Stuyvesant 146 Halsey Street All Points RE Sunday 1:30-3 $795,000 (was $995,000) GMAP P*Shark

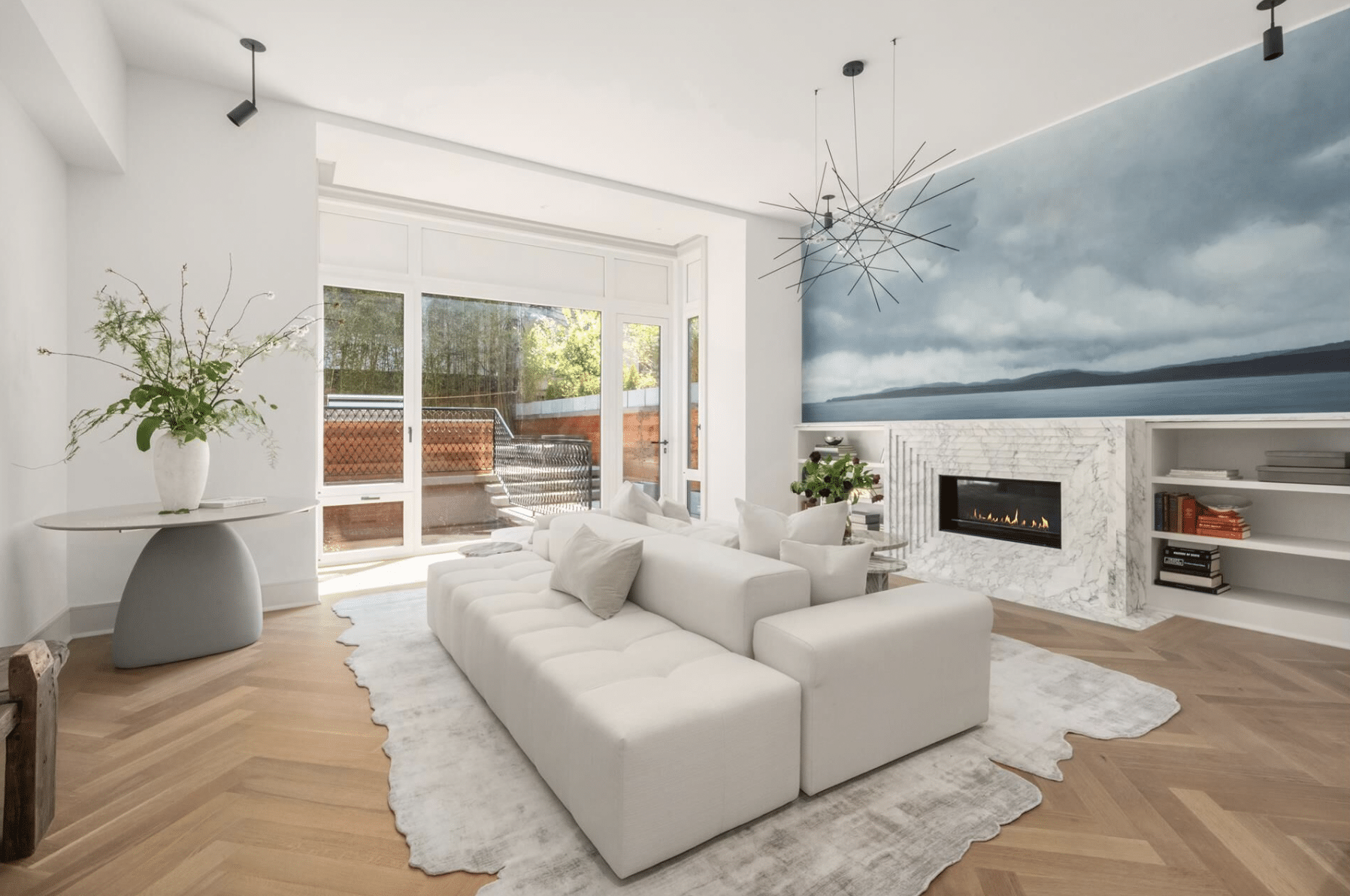

169 State Street

Stribling

Sunday 12-2

$2,495,000 (was $2,995,000)

GMAP P*Shark

438 7th Street

Brooklyn Properties

Sat & Sun, 1-3

$1,950,000

GMAP P*Shark

270 Sterling Place

Corcoran

Sunday 1-3

$1,500,000 (was $1,500,000)

GMAP P*Shark

146 Halsey Street

All Points RE

Sunday 1:30-3

$795,000 (was $995,000)

GMAP P*Shark

Curious if anyone has seen 270 sterling? pics on the NYT’s site look different than the one here. It was too snowy and cold to make that open house today!

Thank you!!

“Yes, Nomi, we are. Closed about three weeks ago. Two family in Bed Stuy.”

Oh, wow, I didn’t know (obviously)! Congratulations!

Yes, Nomi, we are. Closed about three weeks ago. Two family in Bed Stuy.

Mr. Joist-

My guess is the State Street house needs a lot of work. The first thing the listing says is: “A rare opportunity to either convert to 2 Family or renovate with some cosmetic updating for a fabulous single family residence.” And it’s only 2 houses in from the movie theater on Court (and across from the dumps that penson recently unloaded) so not a super premium location. The current asking price is probably in the ballpark – if there were a widget, I’d say $2.3 – but not cheap. This end of the block is a little hard to sell because the people who’d want to pay a premium for the heights might not consider it, and those who don’t care about the heights premium can find nicer houses in cobble hill or boreum hill just a couple of blocks away on a different price scale.

Mopar, you’re an owner now?

Interesting conversation you two. Glad to see you can mix it up and keep it civil. you both sound pretty convincing to a non-finance person like myself. Hope you actually meet and hash it out face to face.

You’re probably right, denton. You did have to be a bit adroit to get back to those levels at this point in time.

Also you’re right on the SP500. As i posted above, the ten year return for the SP500 to June 30, 2009 was -1.02%

I think Arkady posted the other day that she had recouped most of her losses.

Whuh, you can send them to me. I’m never averse to making money 🙂

Moodys sucks. I hope they lock them up.

dibs, I’d take issue with this statement:

“Unless you were a real speculator in the stock market, most people’s portfolios that I talk to are back to pre-crash levels.”

I’m back to end-of-2007 levels only because I dabble. I’m probably not back to 10/9/07 levels yet. A buy-and-hold investor still has quite a ways to go. Over 4000 on the Dow. The ten-year average return for most equity funds is flat. The ten-year average! The small guy really got screwed this time.